In May 2019, when I started writing Banking on Digital Growth, my primary goal was to educate and empower financial brand marketing, sales, and leadership teams.

I wrote this book to help you.

To teach you.

To guide you.

To transform you. To inspire you. To help you.

My intention when I first started writing Banking on Digital Growth was to transfer everything I know about digital marketing and sales strategies to not only help you but to transform your team and financial brand to be even better.

I could have never foreseen launching a book about digital growth in a post-COVID world. I knew when I wrote the book it was going to be important. But I didn't know how important it was going to be because of the environmental changes we've seen post-COVID.

Recently, I received a note from Leon, the VP of marketing and training for a financial brand in Mississippi.

Leon wrote, "What we thought would be an eight to 10-year digital adoption process on the digital journey has been pushed to the front door of our bank with COVID. Our digital journey seems to be fragmented, and in some ways, we're making strides in our efforts." He continues, "Email onboarding new customers, deep dives of data, customer segmentation, etc.. I'm just frustrated on where to begin to achieve digital growth. Got your book over the weekend." And he admits, "I'm in the Circle of Chaos."

Hearing Leon’s frustrations reminded me of Lonnie, the senior VP for a bank in Wisconsin. When we started with this bank several years ago, they were formerly known as First National Bank of Wisconsin. They had been in business since 1876 and like Leon's bank, they were stuck in the Circle of Chaos that I wrote about in the Banking on Digital Growth introduction. The good news for Lonnie and the First National team is they were able to escape the Circle of Chaos and make continued progress along their digital growth journey. It required a transformation of the entire organization and even their brand, which became what it is now, Fortifi Bank.

When I think about Lonnie and Leon's story, this is why I wrote this book. This is why I didn’t hold anything back. It’s why I shared everything I've gained over the last 18 years of guiding more than 520 financial brands along their digital growth journeys.

When I first started writing this book, I had three people in mind I wanted to help.

1. The financial brand marketer:

Marketing teams often feel frustrated because they want to prove their value in a digital world, but they're viewed by others as a cost center, glorified in-house Kinko's, or worse, nothing more than kids playing with paint and crayons.

I wrote this book to help financial brand marketings team transform the internal perspective of marketing.

2. The financial brand sales leader:

Digital growth is a result of marketing and sales teams working hand in hand together. But there is tension, we’ve noticed, with the internal relationship between marketing and sales at many financial brands when conducting our digital growth diagnostic. More often than not, both feel confused about marketing and selling in a digital world where branches might not exist much longer, particularly post-COVID, as 87% of consumers start their buying journey for a financial product online. I wrote this book to strengthen the relationship between sales and marketing.

3. The financial brand executive:

Long term cultural or organizational transformation will die if there's not enough support and alignment from the top down. Financial brand executives struggle to grow deposits and loans beyond the physical world of branches, beyond the physical world of broadcast marketing. I wrote this book to help the financial brand leaders break away from the Circle of Chaos and fears holding them back.

Banking on Digital Growth is a strategic marketing manifesto to transform financial brands.

But why call it a manifesto?

When writing this book back in 2019, the world was a very different place. And the biggest threats at the time were being driven by the exponential factor of technology.

Those threats are what I call the two C's: Consumers and Competitors.

Consumer demands were changing. Shopping behaviors were being transformed by technology. And technology was allowing the entrance of new competitors into the marketplace. The new competitors were equipped to meet the changing consumer demands and appease those shopping behaviors.

Well, now we have a third C to add to those changing consumer behaviors and competitive threats.

And that comes from the environment with COVID.

Not once when I was writing this book, did I ever think something like COVID would rock our entire world and force change at both the macro and the micro-levels.

The word “manifesto” is derived from the Latin word, manifestum, meaning clear or conspicuous. And this book, this manifesto, is exactly that. It's about clarity. Clarity for the financial brand marketing leader, for the financial brand sales leader, and for the leader on the executive team that might feel stuck in the Circle of Chaos.

Clarity is the first step forward on the digital growth journey. Through training and education, financial brands can gain clarity and become aware of the opportunities going forward.

Through clarity, they begin to overcome the fear of the unknown.

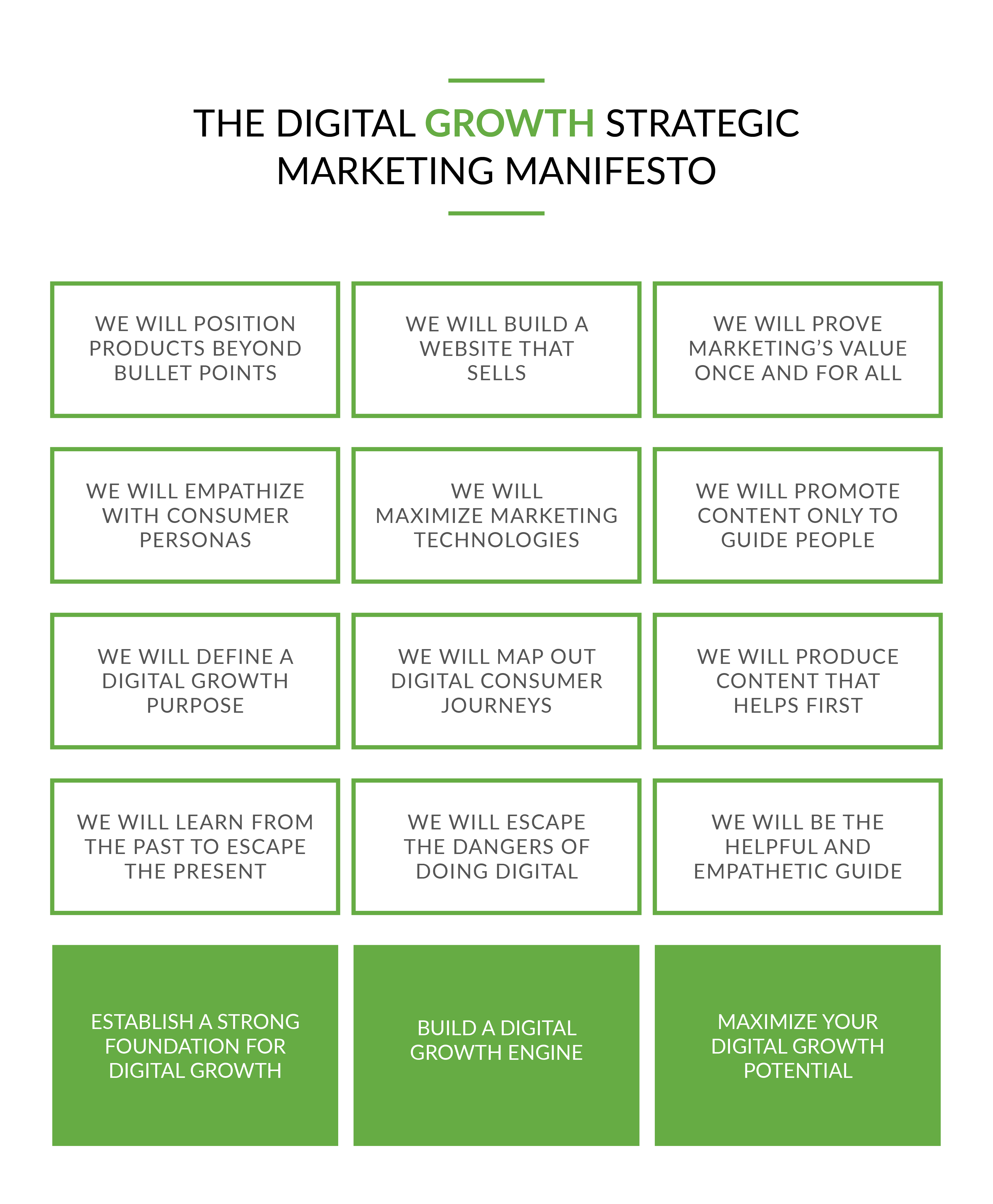

The Digital Growth Strategic Marketing Manifesto comprises 12 proclamations, or calls to action, to inspire and guide you to ultimately move forward and make progress along your own digital growth journey with confidence. In the book, we dive into each one of these points to help you gain clarity and guide you to a bigger, better, and brighter future for yourself, but also for your financial brand.

- We will learn from the past to escape the present

- We will define a digital growth purpose

- We will empathize with consumer personas

- We will position products beyond bullet points

- We will escape the dangers of doing digital

- We will map out digital consumer journeys

- We will maximize marketing technologies

- We will build a website that sells

- We will be the helpful and empathetic guide

- We will produce content that helps first

- We will promote content only to guide people

- We will prove marketing’s value once and for all

Commit to Take Action

Select one of the 12 proclamations for you and your financial brand to focus on over the next 90 days. Start by assessing where you’ve been, where you are, and where you need to go next within the context of the strategic digital growth manifesto proclamation you choose. From there, craft a strategic plan that provides up to three specific action items you can commit to take action and move forward with as you continue to grow from good to great.

This article was originally published on September 3, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.