Eighty-seven percent of bank shopping journeys start online, according to our research at the Digital Growth Institute. So when it comes to creating leads and driving sales for your financial brand, there is no greater opportunity than digital growth.

But many financial brands are still stuck in legacy marketing and sales systems built around physical branches and broadcast advertising. These old strategies simply do not work in today’s digital world. To compete in today’s world, you need what I call a Digital Growth Engine.

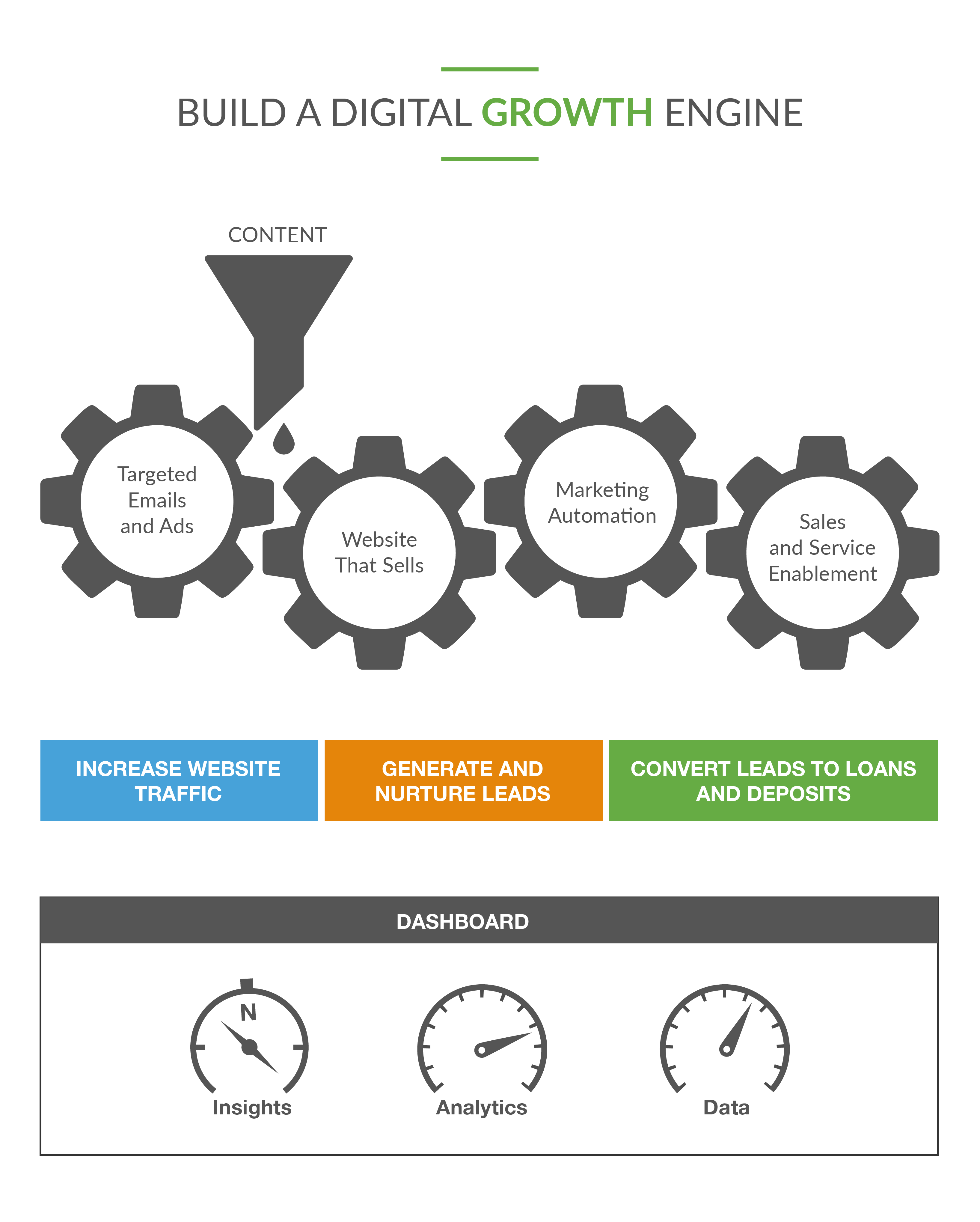

The Digital Growth Engine has four gears, representing the four types of technology platforms needed for exponential digital growth:

The Digital Growth Engine has four gears, representing the four types of technology platforms needed for exponential digital growth:

- Targeted emails and targeted ads

- A website that sells

- Marketing automation platform

- Sales and service enablement

To make these gears run, you need content (the fuel source) and data (engine oil). You also want to use automation and AI, because just like a real engine, you want your Digital Growth Engine, once started, to run on its own as much as possible.

Let’s go through each gear one by one so that you can begin building your own Digital Growth Engine and capturing those all-important digital leads.

Targeted Ads and Targeted Emails

The first gear is targeted emails and targeted ads. If you imagine digital growth like an auto race, this gear is about getting to the starting line. You’re at the very first stage of digital growth, trying to increase website traffic.

Before a race, you want to oil the engine to keep it running smoothly. In our analogy, oil is data.

There are two important data sets to look at. The first is website behavior: what are people looking at on our financial brand websites? The second is purchase behavior: what financial products of ours do people have, what are people buying at stores, where are they shopping frequently, and what are the most common patterns and trends in their spending habits?

Within this data, identify trends, patterns, and associations and, within those, find the opportunities. For example, maybe we try to identify ideal account holders who are in need of a credit card based on spending and credit data. Or perhaps we identify consumers who may be close to heading out the door and closing their account.

With the engine oiled, we can move our car to the starting line—that is, we can send targeted emails and ads, based on our data.

A Website That Sells

After we get to the starting line, it’s time for the race to really begin. This is where the second gear—a website that sells—comes into play. We’ve driven traffic to the website, and now we need to generate leads from that traffic. We need to step on the gas and get out in front of our competitors, and we do that by sending personalized offers to our website’s users.

There are two ways to send personalized offers:

- Rule-based targeting

- Automated one-to-one personalization

Rule-based targeting involves defining rule sets. For example, say you have a home buyer who has previously visited the home-buying pages or mortgage pages on your website. You see that they have viewed three or more mortgage pages in the last seven days. Now you can take some kind of action. This approach allows for fine-grained control over the content you’re delivering, but it can be hard to scale, making the second option useful as well.

With automated one-to-one personalization, you use automation to create dozens of different user experiences and then let the algorithms decide when to feature each one, based on data from the person’s previous website visit or from your core system where all your customer data is kept—or even from looking at third-party transactional data.

Both of these tools—rule-based targeting and automated one-to-one personalization—can be useful. It all comes down to what’s best for your unique situation.

Marketing Automation

After getting a good start, you need to settle in for some lap driving. You want to stay near the front of the pack, in good position to finish the race strong. This lap driving is the equivalent to the third gear—a marketing automation platform, using technology and software to automate repetitive marketing tasks. With your first two gears, you’ve driven traffic to the website and generated leads, and now it’s time to nurture those leads, so that you can close the sale when it’s time.

If you fall behind at this point in the race, it can be hard to catch back up, so this gear is critical. Unfortunately, our research at the Digital Growth Institute tells us about 70 percent of financial brands still to this day do not have a marketing automation platform as a key part of their marketing technology stack.

To get ahead of the pack, you should use marketing automation in three main ways.

First, use it to send the right content to the consumer at the right time, based on where the consumer is in their buying journey.

Second, use it to route the right leads to the right people internally, to get one human being connected with another as early on in that buying journey as possible.

Finally, use it to follow up on abandoned applications. Eighty-five percent to 92 percent of online applications are abandoned, and with marketing automation, we’ve seen financial brands gain 10 to 15 percent more loans and accounts!

By automating these repetitive tasks, you free salespeople up to concentrate on those tasks where a human touch is needed.

Sales and Service Enablement

Finally, the fourth gear is sales and service enablement. This is the finish line of the race! This is where you convert your digital leads into loans and deposits and expand those relationships and opportunities.

You want to finish the race strong and close the sale. The key to doing that is customer relationship management (CRM), which you can optimize using AI, to help manage inbound and outbound sales activity.

We now have the ability to use an AI-driven virtual receptionist for call-answering coverage or have a chatbot work with inbound digital leads. This AI can qualify the lead, collect contact information, schedule appointments, create new contact information in either the marketing automation or CRM platform, and log the call or chat summary. You can use similar AI to power outbound sales activity as well.

Imagine how much time this frees up for you to not have to focus on every lead. Then, for the leads that are the hottest, of course you can get a human being involved. With more time and energy to focus on the hottest leads, your salespeople can be more effective and create a better experience for your consumers.

By leveraging AI in the sales and service enablement gear, you ensure a strong finish, winning the race and closing the sale.

Elevate the Digital Experience

When you combine these four gears, the results can be incredible. With one financial brand we worked with, after they developed their Digital Growth Engine, they saw an 80 percent increase over the following four years in the number of digital leads they generated. Most importantly, conversation rates increased: for one particular loan campaign, they closed 17 percent of digital leads generated.

With all four of these gears, as you use data, automation, and AI, remember that your goal is to elevate the digital experience for the consumer. The future is digital, but it’s also still very human. The Digital Growth Engine works because it improves the consumer experience. So with the consumer in mind, pour in the fuel, oil the gears, start your engine, and get racing!

This article was originally published on July 7, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.