Level Up Your Financial Brand's Marketing Team in the Age of AI

Stop letting unknown customer journey blind spots cost you millions in loans and deposits.

Get weekly marketing and sales insights to level up your loan and deposit growth.

How to Eliminate Your Customer Journey Blind Spots

Step 1

Assess Your Customer Journey

Step 2

Secret Shop Your Website

Step 3

Get Your Digital Growth Strategy

Could you be losing loans and deposits right now because...

You've never mapped out customer buying journeys for your key product lines.

You don't have a way to track conversions for each stage of the customer journey.

You know how people shop has changed, but you lack marketing, sales, and leadership alignment.

Experience remarkable results.

Financial brands that join the Banking on Digital Growth Program focus on loan and deposit growth and marketing ROI, not pointless campaigns, vanity metrics, or commoditized content that promotes the same rates, service, and look-alike product features every other financial brand promotes.

Elevate Your Brand's Digital Positioning

Convert Even More Qualified Digital Leads

Level Up Your Loan and Deposit Growth

Increase Your Team's Confidence

.jpeg?width=450&height=450&name=1516246755917%20(1).jpeg)

Join the Digital Growth Community to connect, learn, and grow with 350+ growth-minded members.

Learn a proven growth methodology to level up loans and deposit growth by inspiring human transformation.

Banking on Digital Growth

Consumers now make purchase decisions long before they walk into a physical branch location, if they walk into a branch at all, while mobile banks, digital lenders, and fintechs have transformed traditional growth models rooted in legacy broadcast marketing and branch sales strategies.

Up to this point you’ve only dabbled in digital marketing without a formal plan or strategy to guide you. Now you feel frustrated because you’re not getting the results you hoped for. You’re also confused about what you should do next.

In Banking on Digital Growth, James Robert Lay unlocks the secrets of digital growth with a strategic marketing manifesto to transform an. You’ll gain clarity with a strategic blueprint framed around 12 key areas of focus that empower you to confidently generate 10X more loans and deposits while finally proving the value of marketing as a strategic growth leader—not a cost center.

Banking on Change

The Age of Artificial Intelligence spares no one from its transformative power. In fact, the rate at which technological change is accelerating is not just significant; it’s exponential in a way that has the power to reshape entire industries, from education to healthcare to banking.

This can feel both exciting and confusing, both opportunity-rich and overwhelming. How do we keep up? How do we move forward? What’s the next best step? The answer here lies in assessing the real obstacle to future growth: human transformation.

With proven models and methodologies that integrate ancient wisdom with practical modern-day strategies, Banking on Change is your ultimate guide to navigating the complexities of change so you can achieve exponential growth with courage and confidence.

The Banking on Digital Growth Podcast

Driving Conversions Through Data-Driven Design for Financial Brand Marketers

-1.png)

Art vs. Science: Transforming Digital Marketing in Financial Institutions

Banking’s Innovator’s Dilemma: What Got You Here Won’t Get You There

Rebooting Banking on Digital Growth: A New Chapter Begins

The Long Game of Marketing: Planting Seeds for Future Growth

.png)

From Artificial to Authentic: Rethinking AI's Role in Human Connection and Banking

.png)

Small Businesses, Big Potential: Navigating Change in Community Banking

.png)

Transform Your Relationship with Money: Changing Beliefs and Building Wealth

.png)

Building Trust in Banking: The Modern Banker and the Wisdom Economy

Subscribe to get new episodes delivered to your inbox every week.

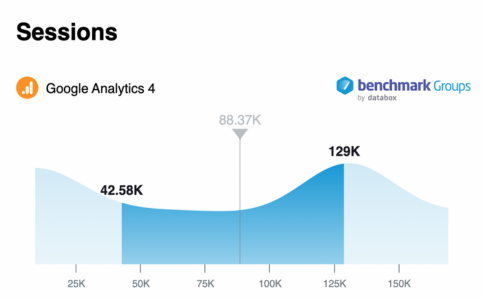

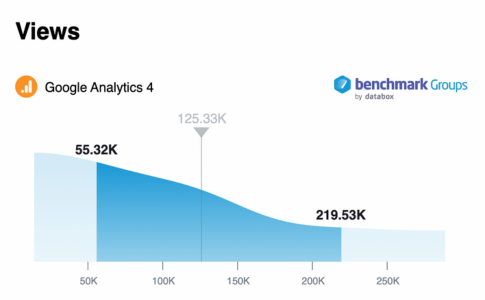

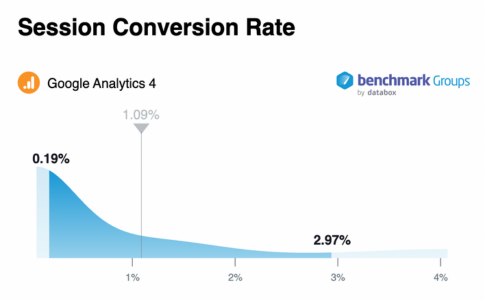

How does your digital growth performance and progress compare to other financial brands?

Find out in less than 30 minutes.

Gain Clarity

See how your performance compares to other financial brands.

Uncover Blindspots

Learn where your digital blindspots are costing you loans and deposits.

See New Opportunities

Learn where there are new growth opportunities to create or capture.

Our Three Promises to You

Everything you learn in the Banking on Digital Growth Program is built on practical principles proven to establish positive habits that improve your sales and marketing results. When you and your team commit to learning and growing together, we promise you will:

Stop losing loans and deposits because of unseen blind spots in your customer journeys.

Break free from promoting commoditized products so you become the trusted guide.

Optimize your buying journeys to level up loan and deposit growth every 90 days.

Listen to Clients Share Their Stories of Growth

Collaborative Learning: The Key to Digital Growth for Banks and Credit Unions

Matt and his team at Salal are testament to what happens when a financial cooperative unites under a shared vision for progress, leveraging collective wisdom to navigate the digital landscape. Their story is an inspiring blueprint for banks, credit unions, and FinTechs eager to unlock their growth potential.

Bringing People Along Through Purpose-Driven Change

One out of every two leaders doesn’t consider the emotional impact that organizational change has on their team members. Yet, the folks at Kindred Credit Union made it clear that they cared about the effect their rebranding had on their employees and customers

Collaborative Learning: The Key to Digital Growth for Banks and Credit Unions

So many in banking are worried automation will replace them. Tiffani not only soothes those worries, she explains just how those extra hours you’ve saved from automation have freed you up to call customers... and give them the experience they deserve.

KEG Culture: On Tap Credit Union’s Recipe For Growth

Digital growth is a journey, where progress is more important than perfection. The 90-Day Growth Method provides a predictable path forward to level up loans and deposits every 90 days.

.png?width=404&height=600&name=3D_Hardcover_Mockup_best-seller_5%20(3).png)

.png?width=2160&height=2160&name=Ashley%20(3).png)

.png?width=2160&height=2160&name=Ashley%20(6).png)

.png?width=2160&height=2160&name=sara%20(1).png)

.png?width=2160&height=2160&name=Ashley%20(8).png)