Find Your Website's Biggest Conversion Leaks—and Fix Them

Gain Clarity

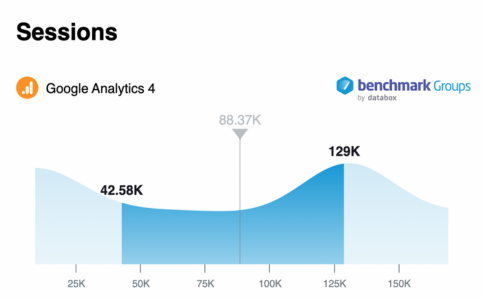

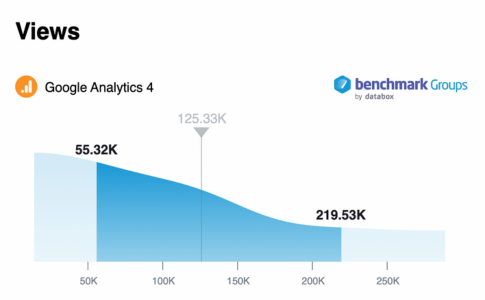

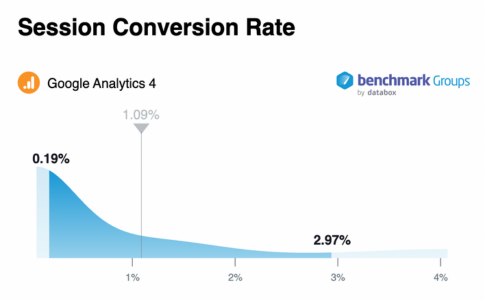

See how your performance compares to other financial brands.

Uncover Blind Spots

Learn where your digital blind spots are costing you loans and deposits.

See New Opportunities

Learn where there are new growth opportunities to create or capture.

You connect Google Analytics

Connect your Google Analytics account with MetriFi and we'll start using the data to build funnels.

MetriFi builds conversion funnels

MetriFi builds your conversion funnels. Funnels show how many people apply for loans and. accounts through your website.

MetriFi compares your funnels with other FIs

MetriFi compares your funnels with other credit unions and banks, so you can see where to improve your site and open more loans and accounts.

Uncover your website's biggest conversion blind spots in just 3 minutes.

Trusted by financial brands.

+$15.1M LOANS & DEPOSITS

"I love their UX design knowledge, technical knowledge, and the value of the A/B testing program.”

+$14.8M LOANS & DEPOSITS

“Everyone I have worked with at MetriFi really cares and they truly understand our industry.”

+$11.4MLOANS & DEPOSITS

“We continue to run A/B tests and our website gets better and better the more we work together.”

+$4.5M LOANS & DEPOSITS

“Everyone at MetriFi is super friendly, organized, knowledgeable, and just overall pleasant to work with.”

Still have questions?

Click here to schedule your benchmark review.

The only cost to schedule a Digital Growth Benchmark Review is 30 minutes of your time.

When you schedule your Digital Growth Benchmark Review, you can expect to:

1. Gain Clarity: See how your marketing and sales performance compares to other financial brands.

2. Uncover Blind Spots: Learn where your digital blind spots are costing you loans and deposits.

3. See New Opportunities: Learn where there are new growth opportunities to create or capture.

A Senior Digital Growth Advisor will guide you through your Digital Growth Benchmark Review.

Once you schedule your Digital Growth Benchmark Review, you will be asked to complete a quick benchmark assessment that will be used to facilitate your call.

-1.png?width=800&height=533&name=Untitled%20design%20(5)-1.png)