For the 25th episode of the "Banking on Digital Growth" podcast, James Robert answered a question from Justin, a South Dakota banker. "We've been talking about data at our bank and we keep talking about data in marketing, but we've not really done anything with that data because we just simply have so much of it. Is there a way that you can help demystify data for us?"

The Four Drivers of Digital Growth

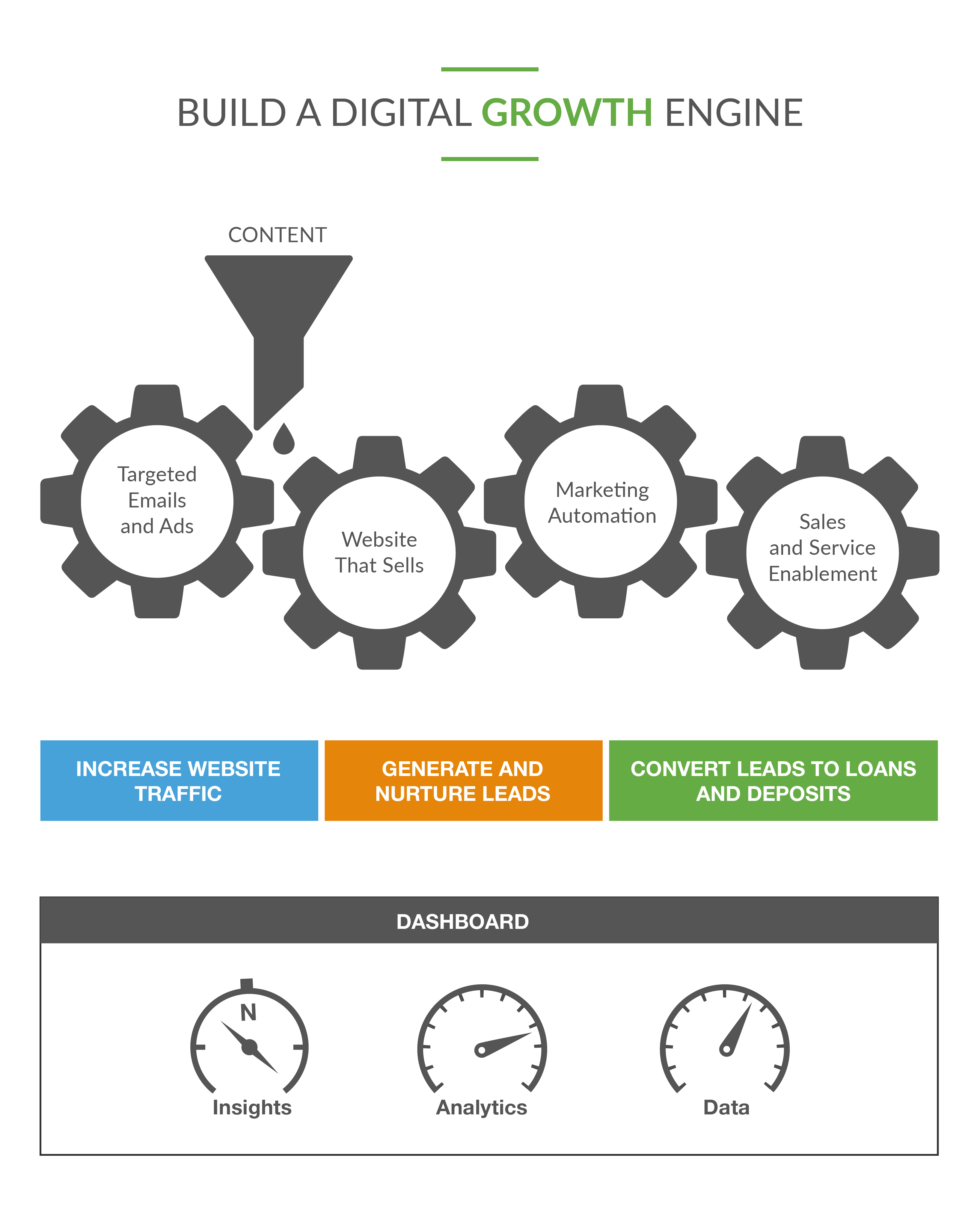

When it comes to data, James Robert breaks down data into a few different parts. Data is what drives the dashboard in the digital growth engine, which is made up of four key gears:

1. Targeted ads and emails:

The goal of this gear is to increase website traffic.

2. A website that sells:

The goal of this gear is to generate leads from that traffic being driven to the website.

3. Marketing automation:

This is utilized to capture and nurture those leads being driven to the website.

4. Sales and service enablement:

This is designed to convert those leads into loans and deposits and expand those relationships and opportunities.

But like any engine, James Robert explains, you need a source of power, or fuel.

Content. Original ads and emails, the sales pages on the website, outreach sent by marketing automation, and even the messages from sales and customer service.

Content to the fuel that drives these engines and turns them as someone moves through the different stages of the consumer buying journey.

People have to get to know a company before they can like and even trust them with their business. With that in mind, financial brands can use their content as a way to introduce themselves to people and begin building a positive relationship.

This all leads up to how to use data.

When looking at content being the fuel of the digital growth engine, powering those four gears, we also need to look at the dashboard to give us perspective and insight into how our engine is performing.

This is where data and analytics comes into play, James Robert shares. The role of the dashboard within the digital growth engine is to take raw data, the ones and the zeros, and turn it into analytics, which helps you to visualize the data.

From there, you can use the data to gain insights, which empower you to make decisions upon what you need to do more of next, or what you need to stop doing all together.

Think of this dashboard like that of a plane. The insights that come from data and analytics are going to tell us whether the plane is ascending or descending. It's going to tell us whether or not we're gaining altitude and what we need to do to course correct.

An example of collecting performance data might be a website heat map to see how visitors actually use the site once they arrive. Do they complete a lead form, click an apply button, or in a worse case, simply back out?

The Two Types of Data

There are two primary categories of data that financial brands can collect. Each one of these are equally important and should be used hand-in-hand.

Big Data

Big data refers to large data sets, both internally and externally, about a group of consumers at the macro-level. These are quantitative numbers such as reach, visits, clicks, etc. As such, it's helpful because it explains what's happening, but it may not completely explain why.

Thick Data

In contrast, thick data helps humanize the conclusions derived from big data. It's more about the stories that can help banks and credit unions understand behavior in the context of their emotions and motivations. Where big data can describe what people do, it's thick data that helps explain why.

In marketing terms, big data provides quantitative information; however, thick data offers the quantitative data. Banks and credit unions may gather thick data from a number of sources, including third parties. Thick data generally comes from surveys, interviews, secret shopping studies, and even social media.

Using Thick Data to Build Empathic Connections With Customers

Empathy is the antithesis of narcisissim. And consumer personas allow us to put ourselves in the shoes of our consumers.

These personas are a strategic tool that provides insight into a financial brand's ideal account holders. They go beyond the traditional demographic data of age, gender, and income. They should also describe motivations and even mental states. Understanding not just what people do, but why consumers behave a certain way.

Consumer personas can provide personalized psychographic insights that are much easier to emotionally and empathetically connect with.

It's the empathic connection that can help develop the relationships and connections that will bring more customers and strengthen their lifetime value.

People don't commit to one bank or credit union or another because they care about serving their bottom line or fitting into some trend line on a graph.

They do it because they believe the bank or credit union can help them solve their problems and improve their lives.

How to Ask the Right Questions to Develop Useful Thick Data

To begin defining and documenting consumer personas at your financial brand, remember the simple acronym as you commit to go ALL in.

You're going to Ask,

You're going to Listen,

You're going to Learn.

That's it. This is how you collect the thick data for your consumer personas.

So what are you going to ask? What are you going to listen? What are you going to learn about?

Here are the key questions to ask people within your ideal market segments:

1. What are their questions and what are their concerns? What is keeping them up at night?

2. What are their hopes and what are their dreams? What do they want to achieve with their bigger, better, brighter future?

Banks and credit unions will find that they have multiple groups of potential and current customers with various kinds of concerns. Still, they can develop consumer personas that can help define audiences for marketing campaigns to respond to the different groups. Beyond the initial ads and emails, this kind of information will help financial institutions design landing pages, marketing automation content, and even inform their sales and service representatives.

By learning the answers to just these few questions, banks and credit unions can come up with the clarity they need to develop content that engages consumers enough to begin developing the emotional connection that will give them a tremendous advantage over their competitors.

To have impact and create value, data needs stories and stories need people. Stories need personas. Because without stories, without narrative behind the personas (thick data), there is no emotional context into the "why." Then you can focus on learning and understanding people's questions, concerns, hopes and dreams.

This article was originally published on January 12, 2021. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.