Financial brands are all about the numbers. So it makes sense that when you want to define and segment your audience, you turn to the hard data of demographics.

But demographics are missing something very important: empathy.

Let me show you what I mean. I’m going to describe a target consumer in two ways.

Option 1: 22- to 40-year-old woman. College graduate in a white-collar position. Income between $45,000 and $125,000.

Option 2: Jenny is 30 years old. She’s been working hard to build her career, and now that she’s in a solid place financially, she’s looking forward to the future. She wants to buy a home soon—a place where she can start her family. But she’s not sure what she can afford and is worried about losing the financial stability she’s established. She wants someone with expertise that she can trust, who she knows won’t take advantage of her.

Who do you emotionally connect with more—the 22- to 40-year-old woman, or Jenny? The obvious answer is Jenny.

This is the power of consumer personas: semi-fictional representations of your ideal account holders, based on market research and real-world data.

But why does that emotional connection matter? Let’s take a closer look at why empathy is important to marketing and how you can create that empathy through consumer personas.

Why You Need Empathy: The Competitive Advantage of Consumer Personas

When most people think about banking, they don’t think of empathy, but empathy is quickly becoming the biggest competitive advantage for financial brands, especially in a digital world.

In the past, people chose financial institutions based on physical considerations, like location of branches. But as Brett King, the founder of neobank Moven, once wrote, “Banking is no longer somewhere you go, but something you do.”

I would argue that banking has evolved even further, to something you experience, and experience is all about how you feel.

Technology has given rise to an educated and empowered consumer—they control the communication they receive, as well as the individualized buying journeys they choose to take.

If you want to attract this consumer, you need to understand why they do the things they do. You need to understand their concerns, anxieties, needs, and dreams. In short, you need empathy.

When you empathize with your consumers, you can better understand what they want and need, allowing you to frame your financial products and services most effectively.

One of the best ways to build that empathy is consumer personas, but unfortunately—or fortunately, depending on how you look at it—this is something many financial brands just don’t get yet. In fact, in our research at the Digital Growth Institute, we’ve found that 68 percent of banks and credit unions have not created or defined consumer personas.

Even among those who did report having defined personas, the vast majority aren’t applying these personas in their digital marketing strategies. This means there’s a huge competitive advantage to be gained by creating consumer personas. Let’s explore how to do that.

How to Build a Consumer Persona: Big Data and Thick Data

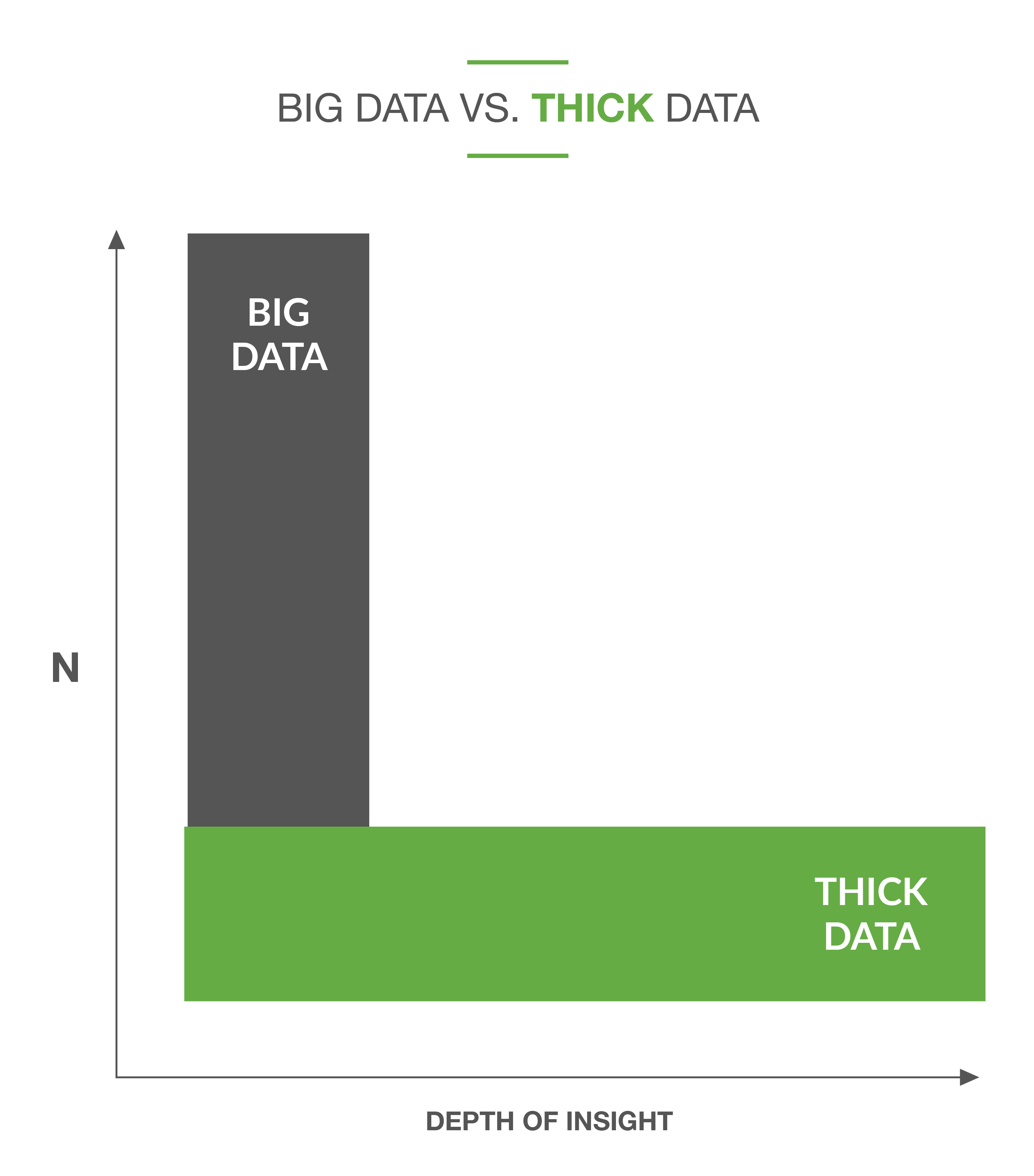

To build a consumer persona, you need both “big data” and “thick data” on your ideal consumers.

Big data is the kind of data you’re probably most used to. Big data is collected from large data sets, both internal and external, about a group of consumers. Big data informs you about what people do by describing consumer behaviors through trends and pattern matching at scale.

Demographic info—age, sex, education, occupation, income, and so on—falls under big data. Note that demographic data is an important piece of your consumer persona; it just can’t be the only piece.

Thick data is what really brings value to a consumer persona. Thick data is the qualitative information collected from a subset of individuals to better understand their emotions and the motivations behind their behavior and choices. Thick data doesn’t necessarily have as large of a data pool or data set as big data, but the insights gained from it can be even more revealing.

Essentially, big data tells you what people do, but thick data uncovers why they do what they do. Thick data is key to building that all-important factor of empathy.

With thick data, you are seeking to define two things:

- The current emotional reality of your ideal account holder and where they feel stuck by their questions and concerns

- The bigger, better, and brighter future your ideal account holder wants to create by realizing their hopes and dreams.

To define these two areas, ask people within your ideal market segment the following:

- What are your questions? What are your concerns? What’s keeping you up at night?

- What are your hopes? What are your dreams? What do you want to achieve in the future?

The answers to these questions give you the opportunity to objectively identify solutions that solve the consumer persona’s pain and guide them to their ideal future. This leads to incredibly effective marketing.

The Power of Personas

Ultimately, people don’t buy financial products and services; they buy shortcuts and solutions to solve their problems.

Once you’ve identified your financial brand’s consumer personas—their questions, concerns, hopes, and dreams—you’re in a better position to understand how your products can serve as solutions and cures to their particular problems and pain points.

When you lead with this understanding in your marketing, consumers will respond. They’ll think, Wow, they really understand me. They know how I feel. They really get where I’m at today.

This emotive connection will build trust with your consumers, making them more likely to choose your financial products and services as the shortcut to solving their problems.

So, say goodbye to the “22- to 40-year-old woman,” and start marketing to Jenny, or Davis, or whoever your ideal consumer happens to be!

This article was originally published on July 20, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.