What's your plan?

Or better yet, do you have a plan?

What's your plan to move forward with courage and confidence to generate 10X more loans and deposits really now in this post-COVID-19 world?

10X. That’s right, 10X.

10X more loans and deposits. Is that even possible? Is it just hype? Let's dig in a bit further to get to the truth because 10X growth is only the direct result of 10X thinking.

But here's the problem: Financial brand marketing teams are greatly misunderstood and substantially undervalued. Generally speaking, of course.

Time and again, I hear financial brand marketing team members admit that they feel they're viewed by others at their organization as nothing more than cost centers. What’s worse? Some have even shared that marketing is viewed by others as nothing more than kids playing with paint and crayons all day.

What if this negative image was turned on its head?

What if your marketing team stopped feeling like overwhelmed, frustrated order-takers?

What if instead of taking marketing for granted, financial brand sales and leadership teams saw marketing as the trusted vehicle to drive your financial brand towards future growth in this post-COVID-19 world?

Now, I am not exaggerating when I say 10X growth is totally doable.

I've seen it.

I've seen this level of growth firsthand time and again for different financial brands that deploy the thinking we teach here at the Digital Growth Institute. In fact, I've seen financial brands experience 15X digital growth.

This is why I wrote the book Banking on Digital Growth, not just to save financial brands from extinction, which is a reality that is even more real post-COVID-19, but to transform financial brands. I don't just want financial brands to survive.

I want financial brands to thrive.

The way to do this is through 10X thinking.

If you want exponential digital growth, you're going to need to transform your entire way of thinking. Then, transform your team's entire way of thinking, followed by your organization's entire way of thinking. Your marketing, sales models, and all the habits that go with it will need a complete transformation.

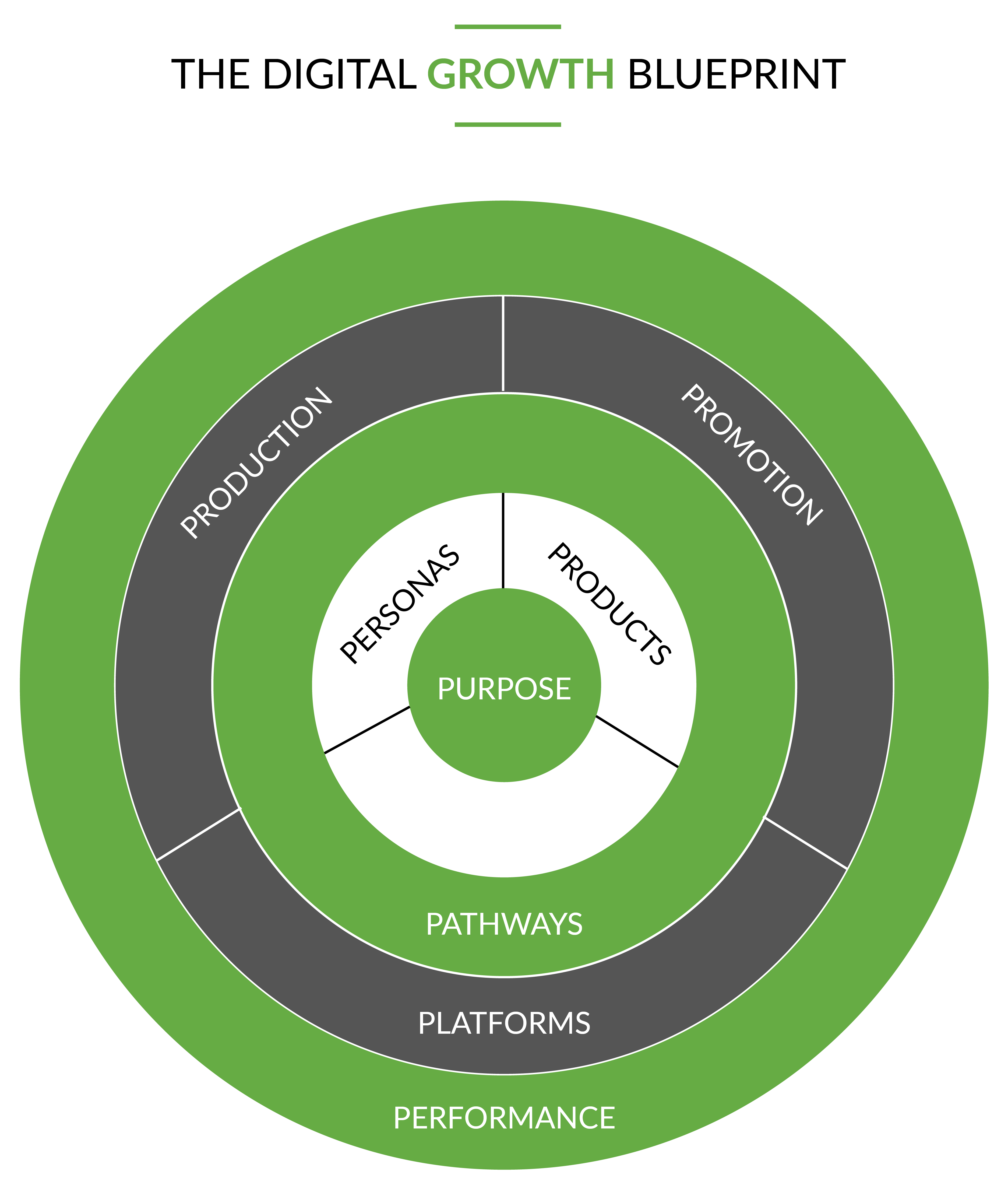

But how are you going to do this? I invite you to use the Digital Growth Blueprint. That's what I unpack for you in the book Banking on Digital Growth.

Separating the Digital Haves and the Digital Have Nots

The Digital Growth Blueprint is broken up into 12 key areas, and each one of these areas builds upon the other. But here's the secret: The different areas that make up the Digital Growth Blueprint are also independent. In other words, even if you just focus on and commit to one of these different areas, this effort alone can empower you and your financial brand to improve your marketing strategy. However, if you focus on all of the different areas within the book, you transform your entire organization to truly maximize your future digital growth potential.

Here's the problem, though: Unfortunately, the majority of banks and credit unions that we've studied and worked with are nowhere close to this when they begin their digital growth journey. Through our year-over-year research, we continue to find an ever-growing digital divide. It really follows the Pareto Principle, or the 80/20 rule. The minority of financial brands, 15-20%, are becoming the “digital haves,” or the digital-first or mobile-first players. On the contrast, the majority of banks and credit unions, 80-85%, are the “digital have nots,” or those that have built their entire business model around the physical world of branches and broadcasts, and they're struggling to transform themselves, their thinking, their behaviors, their action for digital growth.

So why are the 80% having so much trouble?

Digital growth requires so much more than just adopting the latest and greatest marketing and sales technology. In fact, one of the most important elements of digital growth is something that is ancient and timeless. This element is typically left out altogether at the executive and board level because the conversations are primarily focused on technology alone.

Humanity

It's people. And people still trust people far more than they do financial brands. There's something about connecting with another human being that makes people feel good, and it's important for you and your team because the nature of financial services is inherently complex.

Whether the human connection is made via online chat, Zoom, or face-to-face, it isn’t the channel of communication that matters; It’s the human connection itself. Branches might not be disappearing entirely yet, but they are no longer the transactional centers for deposits, transfers, payments, or the place to begin building a face-to-face relationship.

In today's digital economy, I predict branches will be centers for financial coaching, guidance, and accountability, which will support a digital-first growth model. How can financial brands develop digital-first coaching programs to support a digital-first marketing effort?

Consumers do not want to hear you talk about or brag about your commoditized rates, your amazing service, or your laundry list of look-alike product features. Instead they want you to meet them where they are on their own journey of life, and this is one of the greatest opportunities for your financial brand to use the Digital Growth Blueprint that I write about in the book.

The opportunity to educate, empower, and elevate consumers beyond their financial stress to provide helpful content and positive experiences that guide them towards a bigger, better brighter future.

Digital growth is a journey.

It is a journey from good to great.

It is a journey that begins in the mind. Marketing, sales, leadership teams at financial brands must first transform their thinking because then and only then can they transform themselves, transform their teams, transform their organizations, and transform the lives of people within the communities that we all serve. But this doesn't happen overnight. It's like running a marathon. It all starts with proper training and planning.

I encourage you, do not get distracted or lose hope when you want to fall back on old patterns and behaviors that feel safe. Keep your eyes focused on creating a bigger, better, and brighter future for yourself, for your team, for your financial brand, and the people in the communities that you serve.

Forget about perfection.

Focus on progress.

Before long, you and your team will gain newfound clarity. You will build your own courage and commitment and your confidence will grow. Not only will you establish new digital marketing and sales systems through technologies and new habits, but you will also let go of the past of the limiting mindsets, the old strategies, and the negative behaviors that have been holding you back for so long, ultimately breaking free from legacy marketing and sales systems that were built around branches and broadcast.

You'll get to an exciting future of exponential digital growth.

So enjoy the journey, but remember, it's a marathon, it's not a sprint. And here's the good news: You do not have to run this race alone. I am here to guide you every step of the way.

This article was originally published on August 28, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.