Share this

The BANCER Strategy Circle for Financial Brands: Using the Consumer Journey to Optimize Sales

by James Robert Lay on July 28, 2020

Eighty-four percent of financial brands have not mapped out digital consumer journeys, according to our research at the Digital Growth Institute. Why is this such a problem?

If you don’t have a digital consumer journey mapped out, just think what it means for the person on the other end trying to navigate the complex world of buying a financial product. It’s like asking the consumer to walk through the woods at night alone without a flashlight.

Sooner or later, someone’s going to get hurt!

The more you can understand how people shop for and buy financial products in today’s digital economy, the better position you’re in to address any problems that may arise during the consumer journey and lead the consumer from initial interest to final purchase, which means a boost to your bottom line.

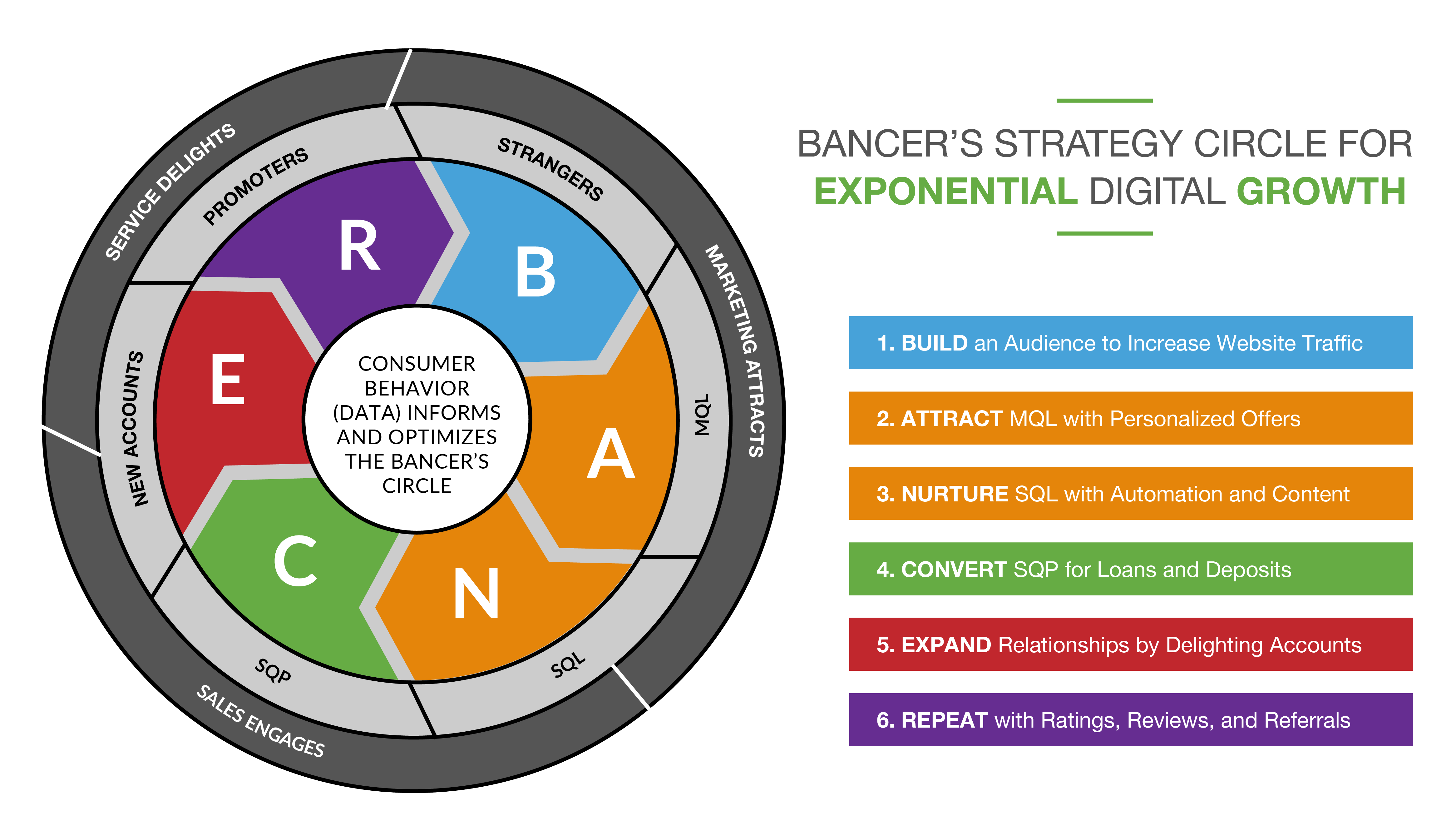

To help brands navigate what actions are needed at every stage of the buying journey, I have created the BANCER Strategy Circle—an acronym to help you remember six key strategic actions that align marketing, sales, and service activities around a centralized operation methodology:

Build an audience

Attract qualified leads

Nurture leads

Convert prospects

Expand relationships

Repeat the process

Let’s examine how each of these actions guides consumers through the buying process, using an example of a financial brand seeking to increase sales for a mortgage offering.

Build an Audience to Increase Website Traffic

Nearly every financial brand understands the importance of driving traffic to their website. However, it’s important to understand that the average consumer does not go from the initial awareness stage of your financial brand and your offerings straight to purchase. They need to get to know you first.

For our example financial brand with the mortgage offering, they initially placed all their targeted ads straight to their mortgage product. That’s not how you build an audience; you build an audience through helpful content.

So one of the first things we did was place ads not for the mortgage product itself, but for helpful content related to mortgages and home buying. At the beginning of the buying journey, consumers want more information, so focus on providing helpful info, not selling.

Attract Qualified Leads with Personalized Offers

After a consumer first becomes aware of your financial brand, they enter the consideration stage of the buying journey, where they start to like you and consider purchasing your offerings.

Too often, the only call to action on a financial brand’s website is to purchase an offering or start an application. It’s important to have transitional calls to action—like downloading a guide or signing up for a newsletter—so that you can engage consumers when they’re in the consideration phase and not ready to commit.

Again, content is key. At this stage, buyers are interested but still looking for more information.

For our example financial brand, to attract leads, they produced a key piece of content called The Complete Guide to Buying the Home You Love. This was a meaty document, about forty pages, and they put it on their website as a transitional call to action for those not ready to apply for a mortgage. In-depth, premium content like this will help you to attract qualified leads.

Nurture Leads with Automation and Content

These days, the buying journey for people in the market for financial products is much longer than you might expect. For a deposit product, like a checking account, we’re talking two to three months on average from the time someone starts looking to when they actually convert. But for mortgages, that window can be six months or even longer!

It’s important that you continue to nurture your leads during that period of time.

Automation is your friend when it comes to nurturing leads. You can use automated emails and chatbots to provide relevant content, follow up, and check in with leads to see whether they have questions or need help. Then, when a human touch is needed, a salesperson can step in.

For our example financial brand, they nurtured leads by continuing to provide helpful content, often through automated emails, keeping leads engaged and steadily moving forward on their buying journey.

Nurturing leads can be the longest part of the buyer journey, but it’s absolutely critical that you don’t let your leads drop off the map, or you’ll never convert those leads to sales.

Convert Prospects into New Loans and Deposits

This is an important milestone—it’s where you close the sale.

When you provide clear guidance throughout the earlier stages of the buying journey, converting prospects becomes much easier. To guide consumers through this part of their journey, include clear calls to action—have a big “Get Started Now!” button for them to click or a link they can click to contact you.

For our example financial brand, they converted sales qualified prospects by getting people to apply for a mortgage online or schedule face-to-face meetings with a mortgage advisor.

This is a critical turning point in the buying journey, so make it as clear as possible what consumers are supposed to do to make that step of conversion.

Expand Relationships Through Delightful Onboarding

Many people make the mistake of thinking the buying journey ends once the prospect is converted. Especially for financial brands, it’s important to continue building the relationship with the consumer. For instance, a consumer’s experience with getting an auto loan from you could determine whether they later choose you for their home mortgage as well.

For our example financial brand, in the onboarding for their mortgage offering, they worked to form personal relationships with their consumers by encouraging in-person meetings. Even when consumers chose not to come to a physical, the financial brand worked to establish human-to-human contact digitally.

It’s something of an interesting paradox: the majority of consumers (87 percent, according to our research) start their buying journeys online, but it’s the in-person, in-branch experience that has the highest pull-through and conversion rate for digital leads.

In order to expand relationships, delight customers throughout the onboarding process with personal, human interaction.

Repeat the Process with Ratings, Reviews, and Referrals

The ultimate end-stage of the buyer journey is advocacy, when an account holder loves you so much they want to tell the world how great you are.

Social proof is critical to the buying journey. The vast majority of consumers say reading reviews is important before making a banking decision. Consumers tend to place more stock in what fellow consumers say, because they know that other consumers don’t have ulterior motives, like you inherently do as the financial brand offering the product or service.

For our example financial brand, they implemented a feature on their website where account holders could leave a star rating and review about their experience.

To complete the BANCER Strategy Circle, create a process by which account holders can leave ratings and reviews and make referrals. That’s how you complete the circle and trigger a repeat of the buying journey with a new consumer.

Map Your Consumer Journey

Mapping out digital consumer journeys is a strategic priority for financial brands in today’s digital world. In truth, consumers want to be guided in their journey. Navigating the complex world of buying a financial product is stressful enough. Without a path clearly mapped out from awareness to advocacy, consumers are certain to get lost during the process.

By mapping out the journey and using the BANCER Strategy Circle, you can ensure that, no matter what stage a consumer is at, they have the resources and guidance they need to make their decisions and move forward. Start by trying this strategy with just a single product or service you offer, and watch those all-important digital leads convert to sales.

Share this

- September 2024 (1)

- July 2024 (3)

- June 2024 (2)

- May 2024 (3)

- March 2024 (1)

- December 2023 (1)

- October 2023 (2)

- September 2023 (3)

- August 2023 (6)

- July 2023 (8)

- June 2023 (5)

- May 2023 (6)

- April 2023 (1)

- March 2023 (5)

- February 2023 (5)

- January 2023 (5)

- December 2022 (1)

- November 2022 (5)

- October 2022 (5)

- September 2022 (6)

- August 2022 (9)

- July 2022 (7)

- June 2022 (6)

- May 2022 (8)

- April 2022 (11)

- March 2022 (7)

- February 2022 (4)

- January 2022 (4)

- December 2021 (1)

- November 2021 (4)

- October 2021 (5)

- September 2021 (4)

- August 2021 (4)

- July 2021 (5)

- June 2021 (6)

- May 2021 (3)

- April 2021 (6)

- March 2021 (3)

- February 2021 (6)

- January 2021 (8)

- December 2020 (10)

- October 2020 (4)

- September 2020 (5)

- August 2020 (9)

- July 2020 (12)

- June 2020 (1)

- March 2020 (1)

- January 2020 (1)

- December 2019 (1)

- July 2019 (1)

- April 2019 (1)

- May 2018 (1)

- January 2018 (2)

- December 2017 (3)

- November 2017 (3)

- October 2017 (3)

- August 2017 (1)

- June 2017 (2)

- May 2017 (1)

- April 2017 (1)

- February 2017 (1)

- January 2017 (1)

- December 2016 (1)

- September 2016 (2)

- August 2016 (1)

- July 2016 (1)

- May 2016 (1)