I want to unlock one of the biggest secrets I share in Banking on Digital Growth.

Fair warning: this secret might offend some of you as it has other financial brand marketing sales and leadership teams over the years. First, let’s review the basics of storytelling.

Every single one of us is on a journey.

Narratives, or stories, are central to human existence. They are patterns we use to make sense of the world and understand others. And in this post-COVID-19 world, I know there are a lot of financial brand marketing sales and leadership teams that are doing a lot of good. They think that they are the heroes for their account holders and the businesses and communities that they serve. Their hearts and minds are in the right place.

But there's a problem. They are wrong with this type of thinking.

Financial brands are not the hero. You are not the hero.

Consumers that are stressed, frustrated, and overwhelmed about their financial situations are not looking for a hero.

Consumers Are the Heroes

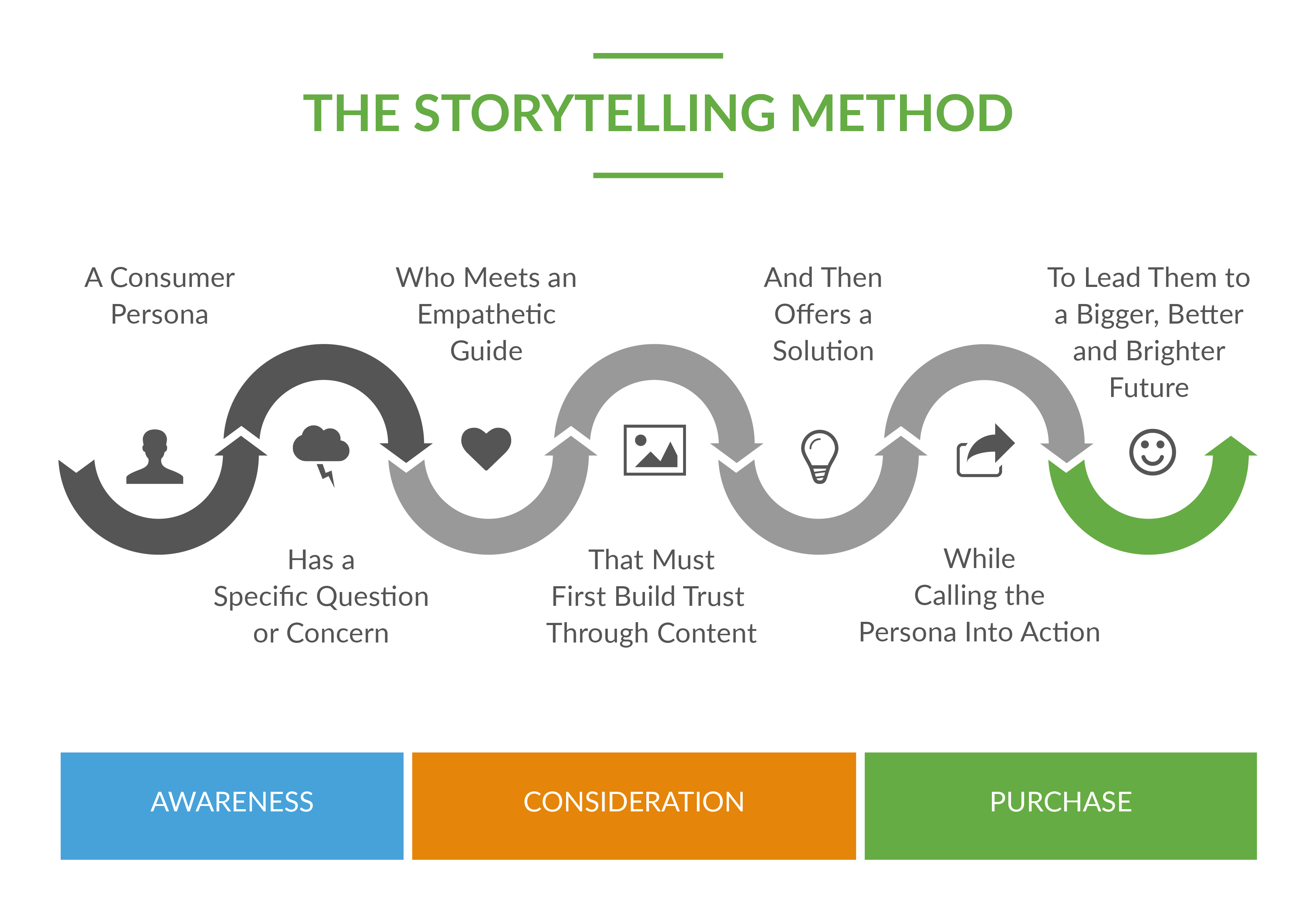

What consumers are really looking for right now is a helpful guide they can trust. A helpful guide that empowers them to break free from the Circle of Chaos. A helpful guide to lead them beyond the financial stress that's taking a tremendous toll on their health, their relationships, and their overall sense of well-being. A helpful guide to lead them towards a bigger, better, brighter future.

When financial brands try to position themselves as the heroes through their marketing and sales communication, they cause massive amounts of conflict in the minds of consumers.

That’s because consumers believe they are the heroes in the stories they tell themselves. This is why consumers must be the hero in the stories banks and credit unions tell both internally and externally.

When you put the consumer and their journey at the heart of all of your thinking, and when you take an empathetic approach to marketing and sales, it is truly a transformative experience.

Not only for your financial brand, but for the people, the businesses, and the account holders you're guiding along their own journeys. And in today's digital world, it is these soft skills of empathy and emotional intelligence that constitute a real competitive advantage for financial brands.

This is significant now more than ever. More and more financial brands and FinTechs are entering the marketplace with business models built specifically around digital and mobile-first growth strategies.

They are transforming the entire industry.

I wrote Banking on Digital Growth for financial brand marketing, sales, and leadership teams that want to be winners in this new digital economy, the fourth industrial revolution. I want to see you and your financial brand continue to grow loans and deposits and continue to help people and businesses within the communities that you serve.

Digital Growth Roadblocks to Eliminate

Although you've most likely already made efforts to move forward and make progress along your own digital growth journey, perhaps you haven't seen the results you've hoped for just yet. The question is why not?

I'm willing to predict that up to this point, based on our continuous studies and diagnostics we’ve conducted for financial brands, you've most likely only dabbled in digital.

You've done everything that you know how to do. You built the ADA mobile responsive website, but it is still just a glorified online brochure.

Yes, you've sent out email marketing campaigns, but they're not as targeted or as personalized as you know they could be.

You've run digital ads, but you question the effectiveness of them because you're having a hard time quantifying conversions.

You've probably also posted content on social media, but you're questioning if it’s really worth the time.

You feel stuck and you don't know why.

You want to find a better path forward and you see the changes in technology, the changes in consumer behavior along with the new consumer behaviors, that are being shaped and formed because of COVID-19.

And you see the competition and how they're continuously evolving at a much faster pace and taking market share.

All of this, all of this change, has been just further amplified because of the COVID-19 crisis.

There's something preventing your marketing, sales, and leadership teams from realizing your digital growth potential to maximizing. It’s most likely caused by legacy systems. Thinking that was already put in place long before you got to where you are today. It’s these exact legacy systems, these mental models, that threaten to hold you back.

Progress is being prevented by, what I call, the “Wall of Fear.”

The Wall of Fear

Financial brands are held back by four distinct fears that keep them from fully committing to their digital growth journey. In a positive environment and culture, these fears are sometimes spoken openly. But more often than not, these four fears have been whispered to me in confidence.

1. The Fear of the Unknown:

"I know digital is important for us, but what should we do next? I'm confused about everything that's going on. It's happening way too fast."

2. The Fear of Change:

"Why do we need to change now? We have been successful up to this point."

3. The Fear of Failure:

"What happens if we try this and fail? What will they think of me? I don't want to mess things up."

4. The Fear of Success:

"What happens if this actually works? Can we even support this new type of growth?"

Three Key Questions

1. Do you feel like you might be stuck in a Circle of Chaos, feeling a little confused, frustrated, and overwhelmed about digital growth? If it's not you, maybe it's someone else on your team, a peer, a colleague, an executive team leader, or someone on the board of directors.

2. How might the four fears be holding you back from maximizing your financial brand’s future growth potential?

3. What's your plan? What is your plan to move forward with the courage and confidence to generate 10 times more loans and deposits? There's that phrase again. 10 times. 10 times more loans, 10 times more deposits, but why 10 times?

This article was originally published on August 24, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.