If you were to gather your entire organization into your boardroom at the same time (or in this case, the same Zoom room), and give them 30 seconds to jot down what they believe a digital growth is….how do you think the responses would line up?

I predict we would see quite a few online banking or mobile banking focused answers. In fact, I would bet a majority of responses would revolve around these platforms or other technology tools.

But answers like this begin to surface a critical knowledge gap. And the difference between filling this gap and leaving it empty, full of cobwebs and dust, is the difference between elevating your financial brand above the rest who are primarily focused on still promoting commoditized products and features.

People are looking for three things in this post-COVID world. They are seeking health. They are looking for wealth. And they are simply hoping to be happy.

So in order to help consumers realize these three desires, financial brands must transform the narrative of their digital growth strategy. They must increase trust and provide even more value in the eyes of the consumers.

And all of this happens through a journey of digital transformation that moves the conversation beyond the latest and greatest technology tools.

It is through the digital experience, well-defined systems and processes centered around the modern consumer journey, that we can position our financial brand to achieve exponential growth.

Not sure where to start? Let’s look at four ways to kick start digital transformation at your financial brand.

Step 1: Build Trust Through Purpose

Developing a relationship framed around trust is key to differentiating your bank or credit union from the other financial institutions that simply focus on the promotion of commoditized products, great rates, and amazing service..

How do you build trust? More importantly, how do you build trust digitally when you are not able to see someone and meet with them face-to-face? Well, it doesn’t happen overnight and in fact, before you can even achieve trust, you must first gain respect.

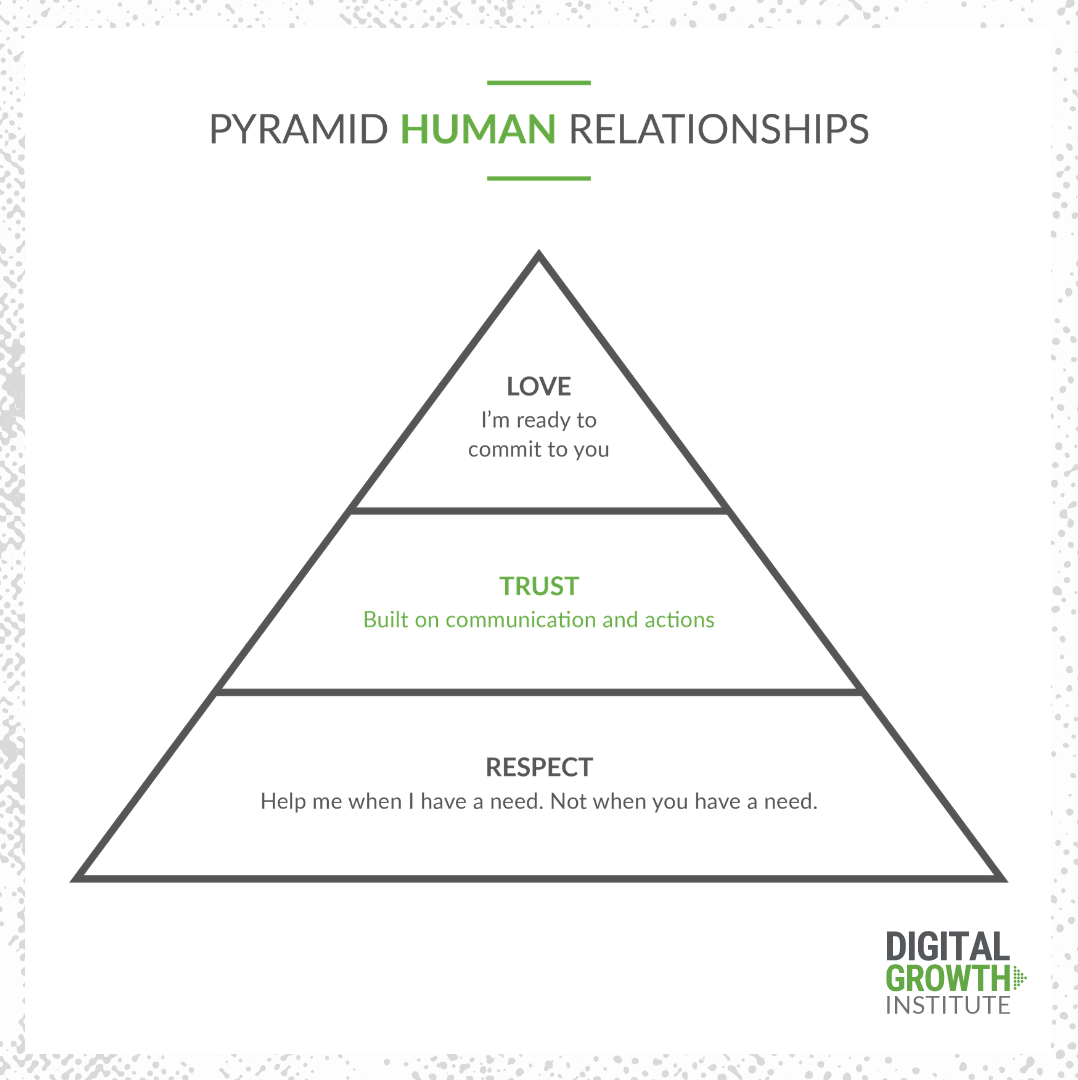

Let’s look at this through the lens of the Pyramid Human Relationships.

The foundation of any relationship is built on respect. This is where you commit to placing the needs of others in front of your own. You help customers when they have a need, not because your financial brand has a need.

At the top of the pyramid is love. Think about love within the Pyramid of Human Relationships as commitment. In this case, digital love is nothing more than hitting the apply button.

So the only way to bridge the gap between respect and love is to increase the level of trust. Building trust comes from two areas: what you say and what you do. Trust must be built with a digital-first mindset.

Having a purpose that’s beyond profits is your key to bridge the consumer trust gap.

To escape the commoditization we have to look beyond the product and the process. We have to look beyond data and analytics. Every other financial institution has checked that box.

Financial brands have to look at people. Who are we creating value for? This is the opportunity to uncover those niche markets. Developing consumer personas allows you to dig into people’s pain points and then provide the solution, or prescription, to their problems or concerns.

Once we clearly understand who we are helping, we can then focus on the purpose.

Why are we doing what we are doing? How does purpose translate into the communities that we serve? And most importantly, purpose is not driven by the financial brand’s own interest.

Your digital purpose is the North Star at your financial brand. It’s the guiding principle for where you go in the future.

And as we can learn from ancient wisdom even in the Age of AI, profit will always follow the purpose.

Step 2: Meet People Where They Are

In order to meet our account holders where they are, we first have to take a look inside our internal organization. Identify how your financial brand, as a whole, is thinking about digital. And as I’ve mentioned above, we have to reshape and refocus our perspective that digital growth is nothing more than the latest and greatest technology.

In order to meet people where they are - in their consumer journey - we have to create the roadmap...the individualized home, auto, or business buying journeys. Each product should be broken down into personalized, micro journeys.

But it can’t be all about the product alone. Provide prospective account holders with guidance. Have the education piece to deliver along with the product. Offer a home buying or business growth guide. Make it a package deal with an expert coaching session.

Furthermore, think about technology as the medium. It is a tool that brings people together.

It brings people together so that you, the financial brand, can offer them hope and help towards a bigger, better, and brighter future.

Step 3: Commit to Communicate Courage and Confidence

As we mentioned technology being a medium or communication channel, commit to using video to humanize your financial institution as you communicate courage and confidence. Put a face to your brand. Give leaders a voice and the confidence to help guide others forward beyond the financial stress that takes a toll on their health, relationships, and overall sense of wellbeing.

But what if myself or someone on my team isn’t comfortable being on video or holding live conversations? What if we are too caught up in being polished and perfect?

That’s the beauty of humanizing digital channels.

What’s more human than having a live conversation where mistakes are made?

Lean into the fear. Be vulnerable. And just be yourself.

Whether it’s transitioning from the suit and tie to a collared shirt or from the office to the comfort of their own home, these are behaviors that remove the wall, so to speak.

Utilize Zoom or Facebook Live to make the human connection with your internal team and your community. Consider how the community has transformed over the past six months. It’s no longer defined by physical boundaries. Whether it’s a one-on-one coaching session with an account holder or an online social happy hour for your community members, embrace and capitalize on the human experience --and connection you can make-- through digital communication.

Step 4: Eliminate Internal Friction

I hear this question often...

What happens if my financial brand’s digital transformation strategy is in the hands of the IT department?

We all approach the world from a different perspective. And it’s not necessarily a bad thing to have IT leading the digital transformation...

But, they have to commit to getting inside the head and heart of people within the communities your financial brand serves. And this will only come from those on the front lines...the marketing and sales teams.

IT cannot be focused on technology alone.

The biggest challenge for any transformation is making sure there are healthy and cohesive internal relationships rooted deep within your digital purpose going back to step #1 noted above.

Another area of internal friction is around the idea of the future of work. Something we recently spoke to with Jon Ogden on the Banking on Digital Growth Podcast.

Due to the environmental changes of COVID and the move into the fourth industrial revolution centered around AI, if I’m on the front lines, I’m wondering if my job is safe.

Will I be replaced by a robot? There is a lot of concern out there when it comes to job safety and security.

In the financial world, this is our Super Bowl moment. This is why we do what we do. And this is our time to shine.

Please do note that I do, however, believe your job will be augmented and you must be upskilled or reskilled. Technology or AI will be used to help you do your job even better, so you can spend more time in the human capacity.

And instead of having face-to-face conversations, financial brands employees will have to train and build their capability around digital and video communication with account holders. And this type of digital interaction requires a very different skill set.

As a financial brand leader, there is a need to communicate these changes and opportunities inside the organization. Communicate internally so that your leaders have the courage and confidence to guide your customers towards a bigger, better, and brighter future.

The battle for digital transformation begins in our own minds.

And then, we can transform the self.

Then our team.

Next our organization

And finally, the lives of people in the communities we serve.

This article was originally published on September 21, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.