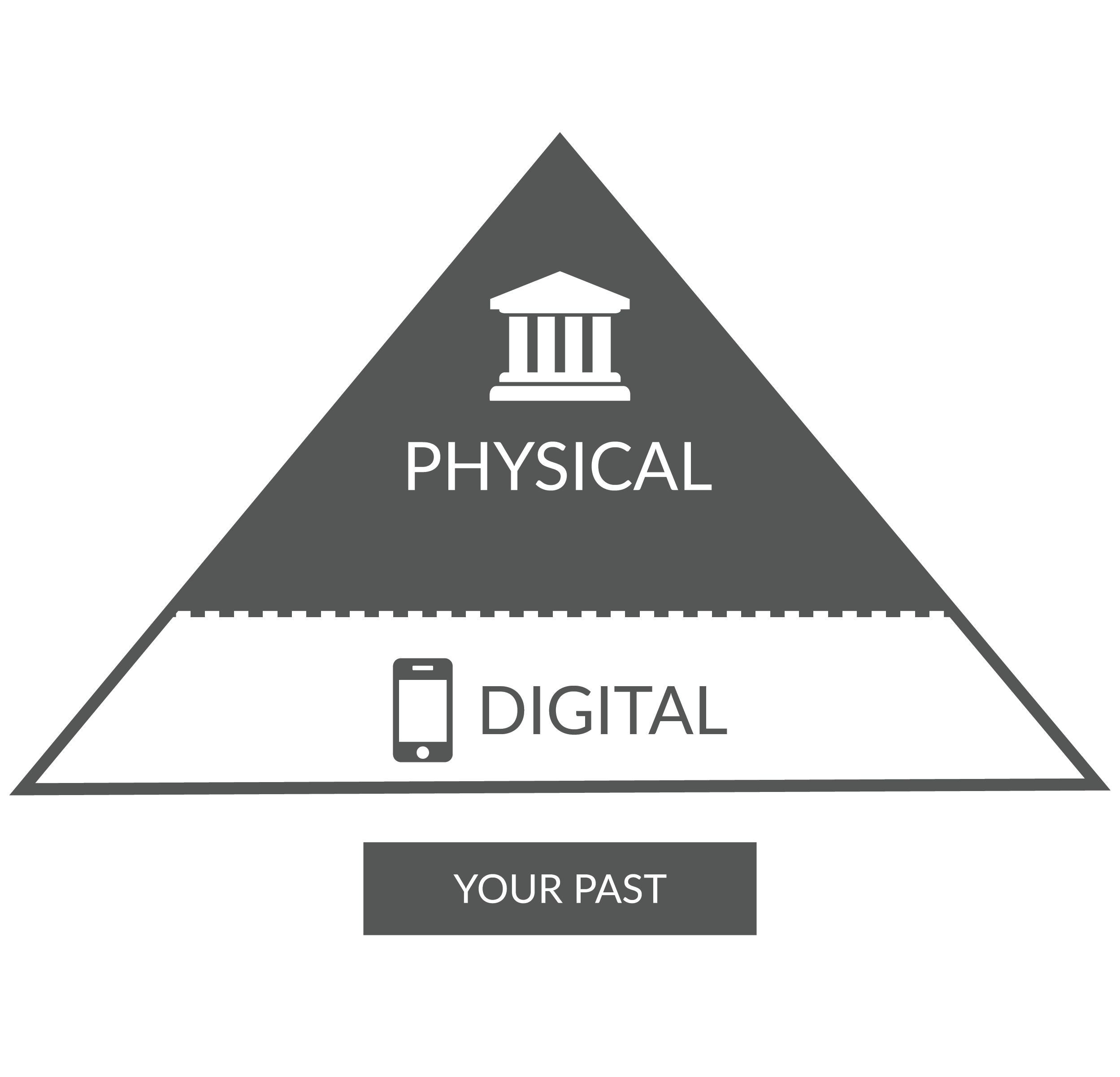

When we think of the old way of doing business as a financial brand, traditionally what we see is a model built around the branch, physical world.

Envision a pyramid.

Three-fifths (at least) of the pyramid is built around the legacy branch, sales, and broadcast marketing model.

Then, when digital came on the scene, digital was bolted onto the pyramid, retrofitted to the old structure.

Are we looking to destroy the old model entirely and start from scratch?

No.

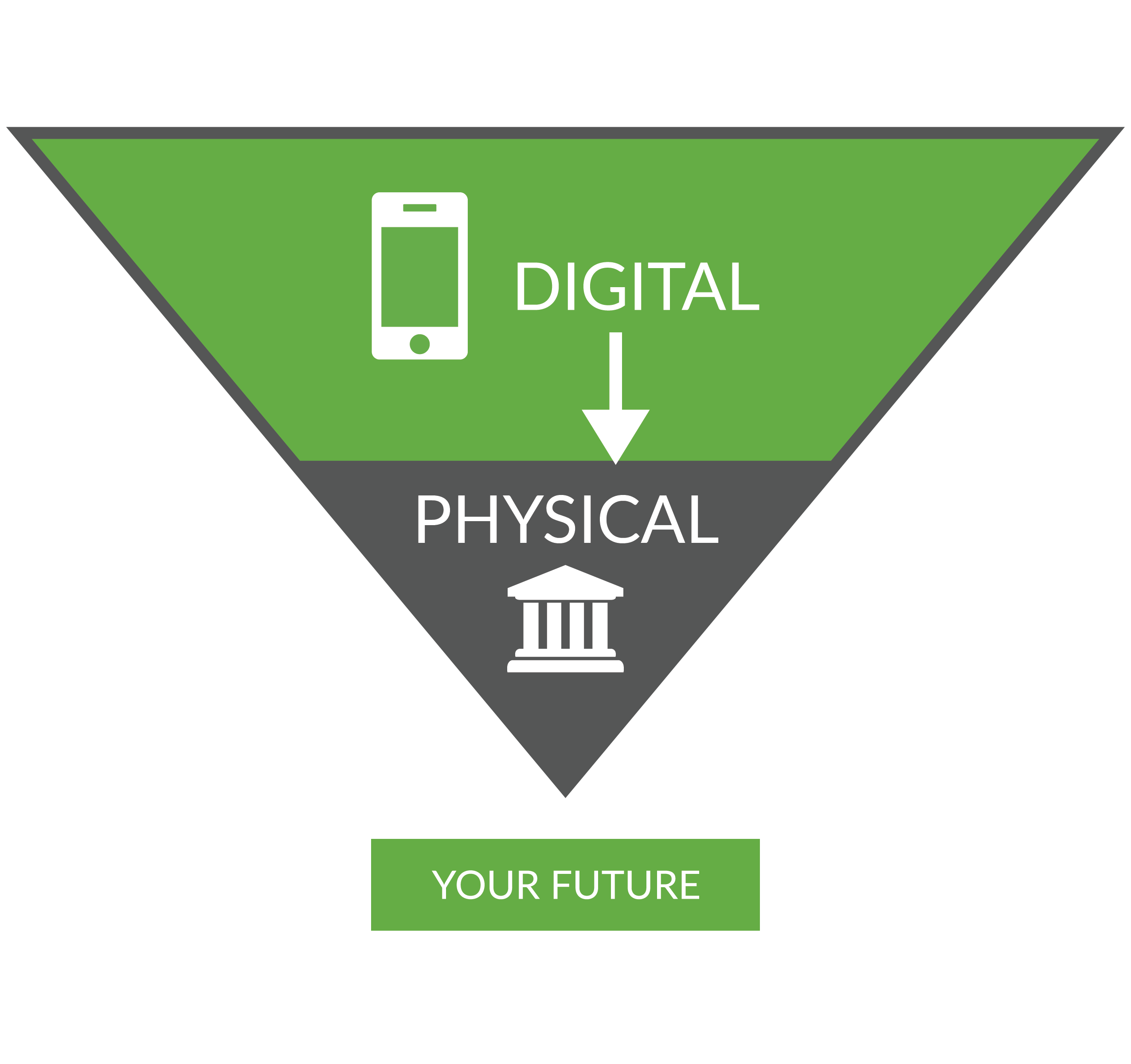

Rather, flip the growth pyramid upside down.

Transform the entire growth model so it’s now three-fifths digital and two-fifths physical—at a very minimum—as digital becomes the primary driver for growth.

Digital is at the heart of the consumer buying journey. With the new pyramid, your growth model will reflect that as COVID has accelerated the need to be digital-first.

Don’t just think about online or mobile banking. Instead think about how you are currently acquiring, nurturing, converting, and retaining leads for loans and deposits?

Transformation Starts with the Individual

When we talk about flipping the model, you are literally flipping people’s worlds upside down.

So we have to be careful. We have to be empathetic because when we talk about change, people go into aa reactive stance. They become defensive. It’s completely natural to want to resist change. And this is why marketing and operational teams experience so much friction at the corporate level.

For transformation to occur, transformation must begin with the individual. It has to start with the self as you think about where you’ve been, where you are, and where you want to be.

This requires AQ. Adaptability.

Like with COVID, we have seen a large amount of transformation in a short amount of time. It is only those who are adaptable, those who are nimble and agile, that will not only survive but thrive.

The good news is... AQ is like a muscle. It can be taught. It can be trained. And it can be strengthened.

Simply by committing to start with small, micro-decisions we will begin to see changes at the macro level.

Where Do We Start on our Digital Growth Journey?

First and foremost, stop talking about change.

If I had to guess, most of us would rather stay in the Cave of Complacency.

Safe. Comfortable. Warm.

But words have power. We all deal with change differently. And that’s okay.

“Transformation” is a different idea than change.

It’s about being better. Creating a brighter future for yourself or your organization.

It’s about surrounding yourself with people who are likeminded and unwilling to get stuck in the GAP (Griping About Problems).

Here are three steps to take as you begin your digital transformation.

Establish a Unified Perspective of Digital Growth

When we’ve asked what digital growth is during our diagnostic studies, we hear the same answers. And it’s all on the service side: mobile banking, online banking, etc. Their definitions fail to address the organizational side: acquisition, nurturing, etc.

We define digital growth as a systematic process, centered on the modern consumer journey, that unites marketing, sales, operations, and IT teams around the following goals: (a) increasing website traffic, (b) generating and nurturing leads, and (c) converting those leads into loans and deposits.

The problem is financial brands tend to turn digital growth into a solution game. We need this tool. We need that tool. But tools alone will not save you.

It’s the systems and processes that will transform your growth potential.

Elevate the conversation beyond the technology.

Conduct an Internal Diagnostic Assessment

Once your financial brand has established a unified definition of digital growth and are ready to jumpstart your journey….

Stop.

When you run a marathon, you don’t just start running. You go to the doctor for a health check.

An assessment creates value for you, your team, and your organization when embarking on your Digital Growth Journey.

Accept the Path Forward

You don’t start running a marathon on day one. You have to train your body and follow a plan that guides you. Pushing too hard, too fast, too soon, will cause extreme burnout.

The same is true for you and your team. Training and planning help you become aware of the roadblocks you must eliminate and the opportunities for you to capture.

This is why we recommend financial brand marketing, sales, and leadership teams asks themselves how do they want to GRO?

What are your Goals?

What are the Roadblocks preventing you from moving forward?

What are the greatest Opportunities you can capture?

Start small. Tackle one mile at a time and celebrate the progress on the journey.

Let’s look at three ways to start small and build confidence through quick wins.

Step 1: Optimize the Pre-Application Process

Financial brands can show impact and create confidence by re-assessing three key areas on the BANCER Strategy Circle.

- Traffic

- Leads

- Conversions

Typically, all of the frustration and friction on a financial brand marketing team lies at the top of the funnel: Increasing website traffic.

Whether it’s through ads or emails, the primary goal of increasing traffic to your website is to build an audience. It takes time to build an audience and there are not short cuts.

That’s why to get the quick win, financial brands can shift their focus from the bottom up.

Optimize the conversion model, improve the lead generation strategy, and then focus on increasing the web traffic. Otherwise, you are letting opportunities fall through your hand like grains of sand on the beach.

So, how can we optimize the conversion model?

Through the pre-application process.

Capture a name and phone number.

Follow up with the abandoned applications.

I’ve witnessed financial institutions increase their bottom line conversions for loans and deposits by 10-15%.

Better yet, don’t just look at the pre-application process from the internal lense. We have the curse of knowledge. This is why I’m recommending more and more that financial brands run a digital secret shopping studies every 90 days.

Step 2. Build Thick Data Upon Big Data

The role of the dashboard in the Digital Growth Engine is to take raw data and turn it into analytics that you can actually interpret. Then, once you interpret the data beyond 1s and 0s, you can gain insights.

When we think of data from the lenses of consumer persona development, we usually talk through demographic data - age, sex, income.

This data is lacking an empathic or emotional connection with consumers.

We have to put ourselves in the consumer’s shoes. It’s about their “why.”

Why they do what they do.

Step 3: Increase Website Conversion Opportunities

A financial brand would never have someone come into the branch, wait and line, and not be helped.

A consumer would never approach the doors of a financial institution just to find them locked.

And if the website is truly one of the central gears of the digital growth engine and its primary job is to generate loans and leads, why would a bank or credit union not provide the opportunity?

But we aren’t just talking about applying for loans and leads.

We are missing additional opportunities for conversions if we are just focusing particularly on the consideration stage.

Add a secondary call to action, “Have a question? Request a call back.”

That simple call back can create exponential growth in leads. Don’t force users to comb through your site for a contact page. Reduce the cognitive load.

Digital Growth is a Journey

It’s a journey of transformation. A transformation in the mind.

And it is important to remember why are you embarking on this journey in the first place.

This journey is not about you or your financial brand. It’s about the people in your communities. The people that you serve. It’s about alleviating their financial stress and guiding them towards a bigger, better, and brighter future.

This article was originally published on September 19, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.