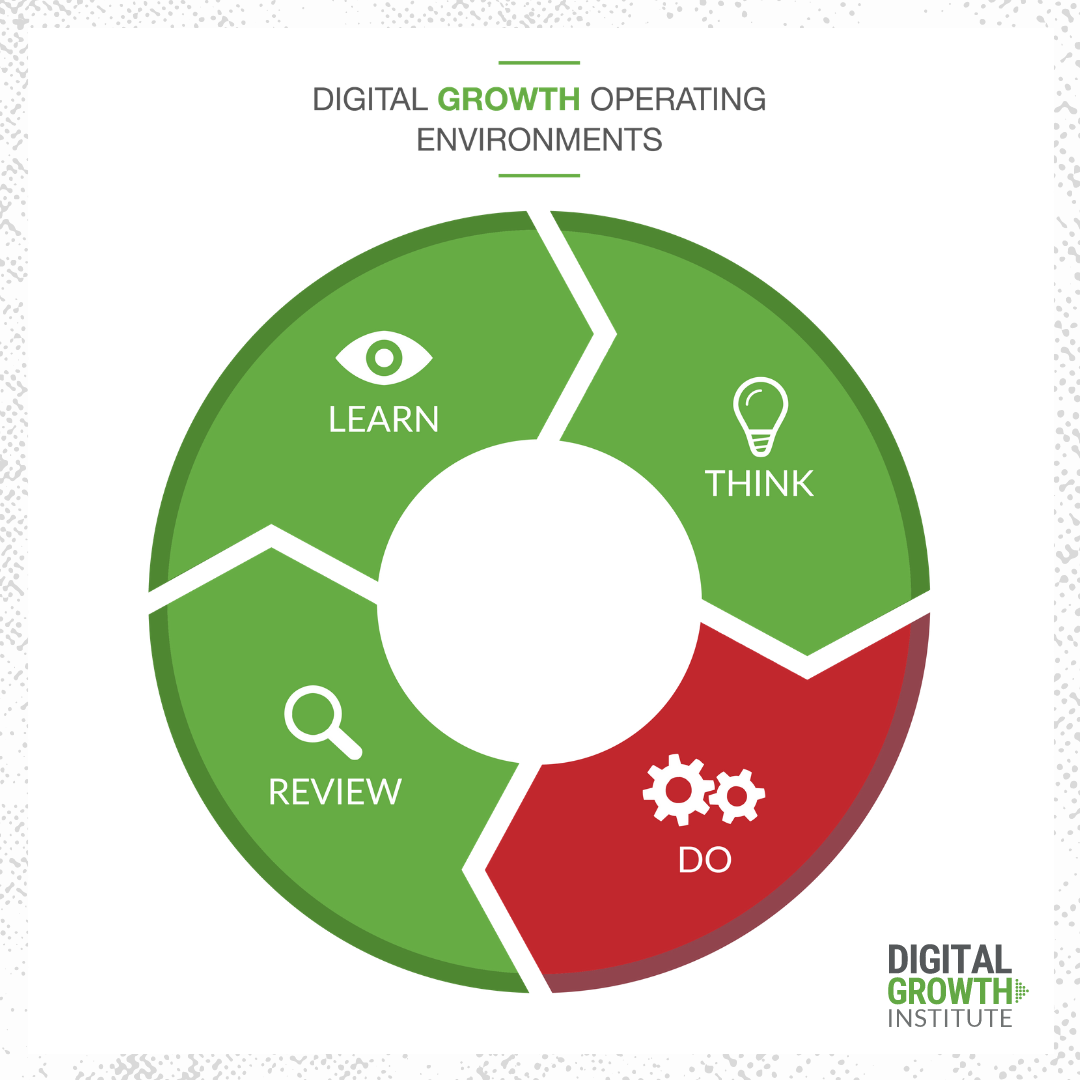

We never had a time—at least in our lifetimes—where we've been able to stop and assess what we are doing and how we can be doing it better. But now, in 2020, the global coronavirus pandemic has given us that time. This Great Pause has thrust us into one of the four digital growth operating environments that we work with financial brands around: review and reflect.

The four digital growth operating environments include:

- The learning aspect

- The thinking aspect

- The doing aspect

- The reviewing aspect

We find a lot of people get stuck in the doing of whatever it is that they're working on, so it is nice to get this time, this Great Pause, to review and reflect, learn something, and apply it going forward.

Shift the Employee Experience

COVID-19 has forced us to shift our employee and customer experiences. Companies have had to figure out how to handle the changing environment for their employees first.

Samantha Paxson, Chief Experience Officer at CO-OP Financial Services, said her team moved to a remote work environment within a week and a half of the first pandemic quarantines.

Samantha said focusing first on the employee experience helped the company be more innovative with changes happening due to COVID. CO-OP also found that employees were grateful for the company’s increased communication and it made them hungry to be change agents and do what was needed for clients.

Samantha also said CO-OP was able to keep service levels and times as solid as possible during this pivot to remote work because, over the past few years, the company has been working to become an agile, responsive platform business. They found that not only has this work allowed the company to bring in new service sets, solutions, and things that would be appropriate in a growth environment, but these changes also worked well in a risk environment.

Digitize the Customer Experience

Financial companies today need to be digital-first. Samantha said the most sophisticated credit unions are looking at all of the ways that they digitally engage around the payment experience, from making the experience more transparent, to embedding themselves in digital merchants, to putting together full rewards programs and marketing programs by using Amazon and other merchants that are digital-first.

The credit unions that are just dipping their toe in the digital water are now seeing a run on debit cards, Samantha said. They have members that are typically cash-only now asking for debit cards, and enrolling in digital pay programs like Apple Pay, Samsung Pay, Garmin Pay. This is likely because clients are asking for contactless point-of-sale experiences, which they’re getting either by using a digital wallet or contactless card.

To keep up with these trends, companies need to be thoughtful about the remote services they offer. Some questions to consider include:

- How are your members going to do business with you, if not in-person?

- What does that journey look like within your credit union, and how do they take advantage of your services?

- Whether it's spend, save, borrow, invest, or protect, what do all of those use cases look like in a remote service environment?

- Due to the pandemic and more contactless, cardless point of sales experiences, fraud is increasing dramatically; how are you making sure that your teams are managing that?

Build Customer Trust

This health crisis has led to a financial crisis, which has ultimately led to a large-scale mental health crisis. In light of this, consumer habits and behaviors are changing.

That means the way consumers are buying, shopping, banking, and paying will change, creating vast amounts of opportunities and challenges for financial institutions, many stemming from both these changes in behaviors, and the increase in financial hardships falling upon consumers.

One of the things that is important to be cognizant of is financial hardships and trust.

Trust will become the credit union's most valuable currency. James Robert has talked about making deposits in a consumer's trust bank: their mind. What can credit unions and financial brands do to make those deposits?

First, think about trust as character and capability. Character is something that credit unions really own, but when it comes to capability, Samantha suggests that you might not trust that a credit union can do everything that you would expect them to do, or in the manner or the method in which you expect it done.

As a result, consumers end up becoming digital nomads who pull in their different use cases from different partners, finding whoever can execute the quickest use case in a mobile environment, resulting in their use of multiple partners.

"The challenge here is that the end consumer doesn't have a good idea of how they're doing in their financial life when they have fragmented all of those use cases. They can't tell: Am I performing on my cashflow? How am I doing with my retirement? How am I doing and saving for my eight-year-old’s college education? What does my insurance look like?" Samantha explains.

Companies have a real opportunity to be there for their members. Now is the time to demonstrate empathy and over-communicate with them about what they can be doing from a financial wellness standpoint. When you put that together, you're building trust and growing market share.

Understand the Customer Experience

It feels like a lot to look at the entire experience that credit unions are delivering in all of their channels and use cases and think about how to optimize this, but COVID-19 is now forcing them to look at their branch experience and ask:

How do we need to change this to make it safe for our members?

They’re being forced to transform the experience they provide already, and Samantha recommends looking externally first when designing these changes.

Look at the basic things that credit unions do for their members: help them save, spend, invest, borrow, and keep their money safe.

Credit unions also tend to cast the widest net possible and try to be everything to everyone. But this is a challenge, especially for community-based financial institutions that have limited resources and staff and can’t compete at the same level as big tech and fintech and the top three banks in the country.

This is why Samantha suggests focusing on a specific type of member and making tough choices about what to cut. What are you going to say no to in order to enhance the experience for this member? You have to get very focused on who your members are and what that experience is across those use cases. Then you get very clear in understanding those members and design your member experience from their point of view.

In order to do this, Samantha believes it's important to journey map and have a cross functional team within your credit union, so you really understand what the membership experience should look like and can collaborate on creating it. There are many choices to make, but being clear about who your target member is and what they want will allow your company to be a lot more successful. Start from the consumer and go in and don't have 72 different consumer types as your personas—really focus.

This is about people putting people at the heart of all of your thinking and doing. It's human-centered design. And, most importantly, it's having the courage to say no and let go of the past. What got us to where we're at today won't get us to where we need to go tomorrow, so courage is really required at a time like this.

That is scary and hard, but it is exciting, too. Credit unions are being served up this incredible opportunity right now to say, “We're an important part of the financial services fabric. We can help people right now. We're here, and we're going to show you how we're going to do it.”

Where to Start on Your Digital-First Strategy

Double down on how you're investing right now. Keeping going with the shifts that you're making. Throw the original budget and strategic plan out the window.

It's important to be focused on a digital-first environment. Look at and evaluate the trends you saw when you made these shifts. What was member behavior like? Be open to really measuring what just happened and saying, “Alight, let's keep going with this” because the digital is going to go faster.

Credit unions have an opportunity to look forward and to say, “How are members behaving and where are our technology competitors coming in?” It’s a change to prove they can be trusted from a capability standpoint. As member behavior moves to having basically everybody do their banking remotely and via a cell phone, credit unions have to be a digital-first remote service and be available in a no-touch environment. That's going to help us speed up this idea of digital transformation.

This article was originally published on December 10, 2020. All content © 2024 by Digital Growth Institute and may not be reproduced by any means without permission.