Share this

In The Financial Industry, One Little Word Can Make All the Difference

by James Robert Lay on February 10, 2021

I recently shared this thought on LinkedIn, and it’s stuck with me ever since:

"Remember that the fundamental opportunity is to help guide people beyond the financial stress that’s keeping them up at night and taking such a heavy toll on their health and their relationships. The goal is to get them to a bigger, better brighter future."

Maybe this thought is staying with me because I think it sums up my greater calling. I’m on a journey, working towards my own personal, big-picture purpose here at the Digital Growth Institute. I’m calling it, “1BXBTR,” which refers to my goal to help one billion people move beyond their financial stress towards just that; a bigger, better, brighter future.

But we can’t make this happen if financial brands continue to operate specifically with marketing and sales in mind instead of the people in front of them. If they are informed by the past, if they continue to promote the commoditized products, driven by profits, they aren’t helping their account holders move past financial stress.

The problem with thinking of growth through the old-world model of broadcast marketing and in-branch sales strategies is that there’s no going forward in this digital world with this mindset.

The greatest growth opportunities for financial brands is to bank with purpose, to commit to putting the transformation of people over the commoditized, transaction of dollars and cents.

What happens when we shift our thinking from profits to people?

When we turn our attention to the people counting on us, the profits will follow.

Why is this true? As we examine what makes people tick—specifically when it comes to shopping and buying financial products and services—it all comes down to one word and that word is:

Trust.

Why Trust Can Make All the Difference

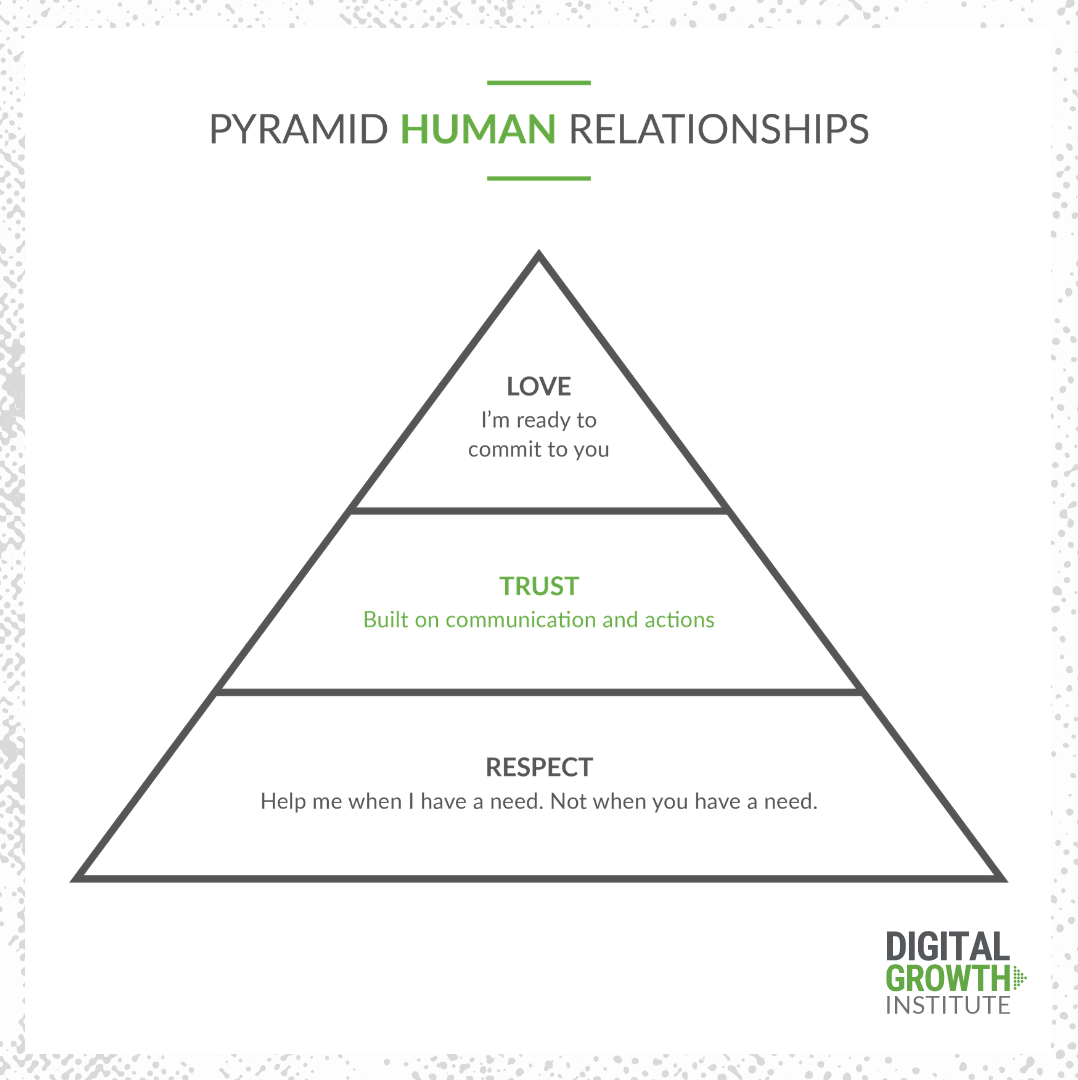

In any human relationship, there are three different levels of connection, which can be described as the pyramid of human relationships. The layers of this pyramid look a little something like this:

- The foundation of the pyramid, the base of any relationship is built on respect.

- The middle layer of the pyramid is what happens when we approach others with respect, when we commit to putting the needs of others in front of our own; we help someone when they have a need and we build trust.

- When our brain or our financial brand has a need at the pinnacle of the pyramid of human relationships, that’s when we find love.

Now, the word love might get a bit confusing here at first glance. This is about financial institutions helping individuals to better themselves. But when we take a closer look and we see that there are many different types of love. In fact, the ancient Greeks believed there to be five different levels of love.

For this purpose, perhaps it's best to think about love within the context of the pyramid of human relationships as trust; the deepest form of connection with any relationship that we have between human beings. Trust is what leads to love.

So for us, the question becomes, “How can your financial brand gain commitment and connection with consumers in the communities that you serve in today's digital economy?”

The only way to bridge the gap between respect and love and commitment is to increase the level of trust, which can be achieved in two different ways:

- Trust is built through communication. Trust is built by what we say and how we say it.

- Trust is built through action. Trust is built by what we do in today's digital economy; in how we commit to our clients and prospective clients.

Today, trust has to be built with a digital-first mindset that has to be established long before a consumer ever comes into a branch to apply for a loan or to open an account.

By having a purpose that transcends profits, we also have a purpose that transcends the promotion of commoditized products.

Empathy: Your Financial Brand's Strategic Advantage

When I talk about love and commitment and bridging the consumer trust gap through digital communications, I’m talking about what we say and (digitally) what we do for consumers, both of which are deeply rooted in empathy.

In today's digital world, empathy is one of the most important competitive strategic advantages, if not the most important strategic advantage you can have at your disposal.

What exactly is empathy? The Lexico Oxford English Dictionary defines empathy as, "the ability to understand and share the feelings of another."

To better understand the strategic advantage of empathy, we can examine two different brains:

The banker’s brain and the consumer’s brain.

The banker's brain, while bold and innovative is going to be more analytical. It’s rational; it's logical.

As for the majority of financial brand leaders, they're often left-brain thinkers, relying very heavily on fact and reason. Make no mistake, this is a good thing because they are dealing with people's money.

However, it's easy for the banker's brain to get trapped in a set, bank-focused way of thinking and view the world through products, processes, and profits.

This is why I encourage financial brand leaders to step out of the banker’s brain and into the hearts and minds of real people.

A consumer’s brain is very different. When we review the world from the mind's eye of consumers—those that are shopping and buying financial products and services—we start to view the world through right-brain thinking.

Right-brain thinking is driven primarily by feelings and emotions; consumers often buy with the heart and with their feelings and emotions. Within the buying journey, consumers are in search of two things: They're looking for help and they're looking for hope.

This is an important concept. Consumers are looking for solutions because they have hope. It’s our job in the financial world to help them see their hope to fruition.

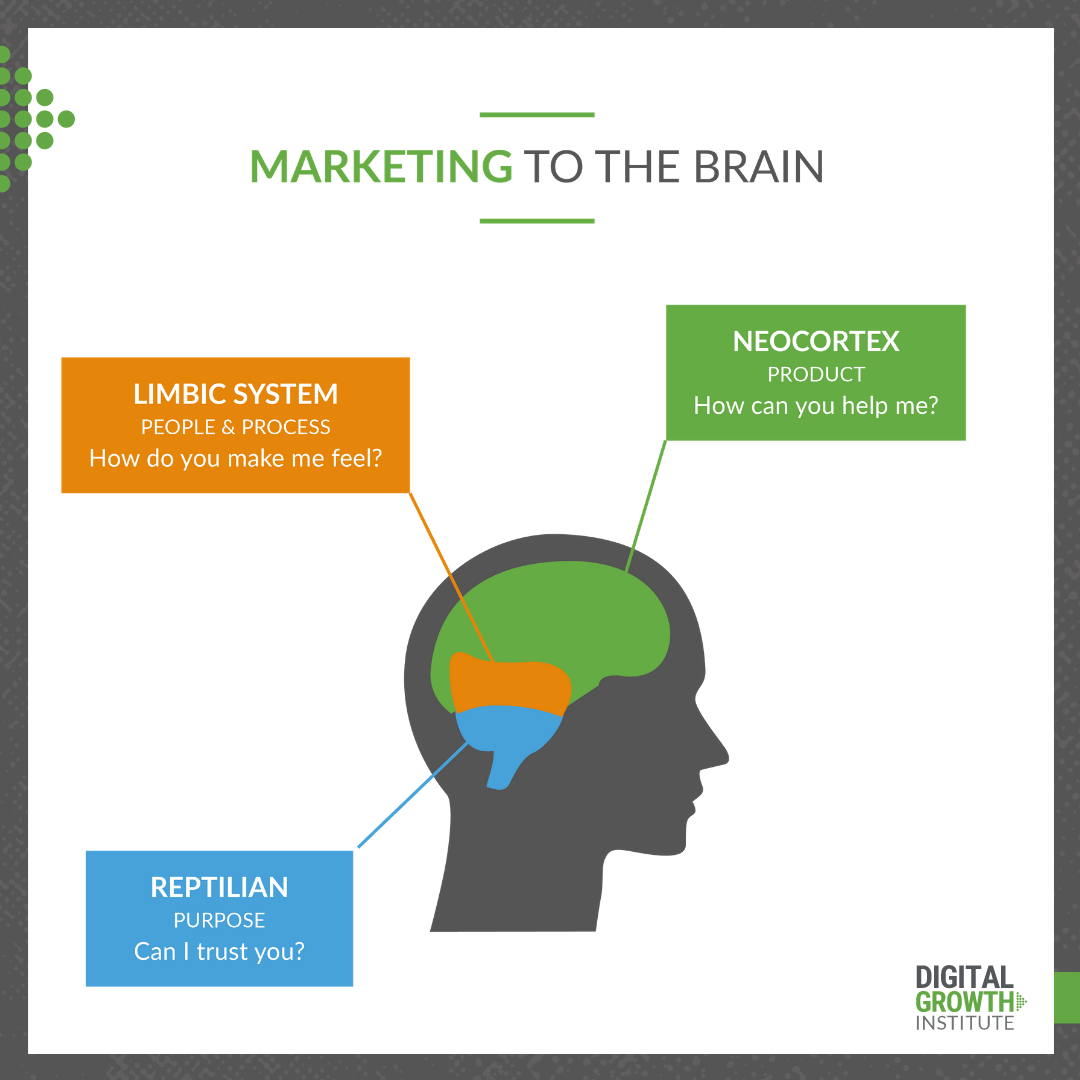

Just how do help and hope show up in the brain? We see these thoughts should up in three key areas of the brain:

- The Neocortex: The neocortex of our brains is our “thinking brain,” where logic and reason resides.

- The Limbic System: The limbic system is our “feelings brain,” and this is where emotion and memories are stored.

- The Reptilian Brain: The reptilian part of our brain is the part that we depend upon for survival.

From a banking perspective, when marketing and sales communication speak to consumers detailing great rates, amazing customer service, and commoditized, lookalike laundry lists of product features, they are speaking to the neocortex; to our thinking brain of consumers.

What's the problem here?

Every financial brand—even in this digital world—is communicating the same thing.

That means when we employ thinking-brain-type strategies, we're all speaking into the crowded and overloaded thinking brain of people. We can’t get in.

Connect with Empathy

How can we use this knowledge to transform and elevate our marketing and sales communication strategies?

We need to reach the other two parts of the brain. When you do this, you add exponential value to your financial brand. More importantly though? You also add value for the people in the communities you serve.

It’s important to note that you can't gain direct access to a consumer's limbic system without first gaining permission; by communicating through the reptilian, survivalist part of the brain. This is where all of your marketing and sales communications strategies need to begin. This part of the brain is all about fight or flight; it's friend or foe.

I like to call this the binary brain because the answers see either one or zero, true or false, yes or no. If the primary question the reptilian brain asks is, “Can I trust this person?” Next, the question being asked by the consumer's limbic system is “How does this person make me feel?” Before we get there though, we first must gain access to unlock the reptilian brain.

When a consumer says, "Can I trust this person?” and the answer is “Yes,” only then can they answer the question, "How does this person make me feel?"

The question of how you make a consumer feel will be answered by your purpose, and by how well you leverage your understanding of the emotional needs of the people within the communities that you serve.

If you succeed in making this emotional connection, it means that you've empathetically connected with your community through your communications and through the actions of your marketing and sales teams. This is where trust is built. Once this happens, you finally have “permission” from the emotional and survival parts of your consumers’ brains to communicate with the rational part of the brain; the neocortex.

Only when we’ve established this deep level of trust can we start talking about our financial institution’s products. Even then, it’s important to not fall back on old patterns and behaviors of rattling off rates or services or features. This is because even at this point, it's not about you. It's about your customers: Their needs, questions, and concerns, as well as their hopes and dreams.

When we focus less on products or services to sell and more on our customers and how we can help them achieve their hopes and dreams, we are finally banking with purpose and empathy.

All of this can then be enhanced by the communications and actions of both our marketing and sales teams. By doing this, we build respect and increase trust.

This is what activates those positive emotions that lead people to fall in love and commit to our financial brands.

The Value of an Emotional Connection

What exactly is the value in finding this emotional connection and commitment?

In a report titled, “Making the Emotional Connection of Financial Services," I found an interesting research statistic that concluded that an emotionally-connected account holder actually creates between 30 and 100 more value for a financial brand than even a highly satisfied account holder.

When we connect with our consumers, we also discover something called a “multiplier connection,” or an “emotional multiplier.” When examining and analyzing all kinds of variables like the number of financial products a customer invests in, we see a multiplying effect in the value added to the account holders who are emotionally connected to our organizations. Emotionally-connected account holders actually have a six times larger lifetime value when compared to the highly-satisfied account holder.

This is why working with strategic principles, rooted in purpose, empathy, and emotion are not just “touchy-feely” subjects. Meeting the emotional needs of your customers creates value that is added directly to your bottom line. That's why it’s crucial that you are committed to maximizing your financial brands and digital growth through purpose and empathy.

When you win trust through communication, through what you say and through your actions, what you do for both your marketing and sales teams, this will naturally become part of your digital environment, where you will reach and connect with consumers.

The Five Primary Drivers of Human Behavior

Professors at the Harvard School of Business have compiled the five primary drivers of human behavior, and in our work with clients and prospective clients, it’s important to keep these in mind:

- The drive to acquire. This everything we strive to gain; it's money, it's status, and ultimately, it's power.

- The drive to bond. This is the need to feel acceptance, love, shared value, and community.

- The drive to learn. Through education, we gain knowledge, which helps us to build confidence.

- The drive to defend. This is all about finding protection and security, and feeling like we are safe.

- The drive to feel happy. This is about our need to appreciate the beauty in life.

When we think about these five drivers of human behavior through the lens of what we say, what we do, what we communicate, and how we deliver these experiences, these five factors are why purpose is what is at the heart of the digital growth blueprint. It is purpose that binds us together.

Share this

- September 2024 (1)

- July 2024 (3)

- June 2024 (2)

- May 2024 (3)

- March 2024 (1)

- December 2023 (1)

- October 2023 (2)

- September 2023 (3)

- August 2023 (6)

- July 2023 (8)

- June 2023 (5)

- May 2023 (6)

- April 2023 (1)

- March 2023 (5)

- February 2023 (5)

- January 2023 (5)

- December 2022 (1)

- November 2022 (5)

- October 2022 (5)

- September 2022 (6)

- August 2022 (9)

- July 2022 (7)

- June 2022 (6)

- May 2022 (8)

- April 2022 (11)

- March 2022 (7)

- February 2022 (4)

- January 2022 (4)

- December 2021 (1)

- November 2021 (4)

- October 2021 (5)

- September 2021 (4)

- August 2021 (4)

- July 2021 (5)

- June 2021 (6)

- May 2021 (3)

- April 2021 (6)

- March 2021 (3)

- February 2021 (6)

- January 2021 (8)

- December 2020 (10)

- October 2020 (4)

- September 2020 (5)

- August 2020 (9)

- July 2020 (12)

- June 2020 (1)

- March 2020 (1)

- January 2020 (1)

- December 2019 (1)

- July 2019 (1)

- April 2019 (1)

- May 2018 (1)

- January 2018 (2)

- December 2017 (3)

- November 2017 (3)

- October 2017 (3)

- August 2017 (1)

- June 2017 (2)

- May 2017 (1)

- April 2017 (1)

- February 2017 (1)

- January 2017 (1)

- December 2016 (1)

- September 2016 (2)

- August 2016 (1)

- July 2016 (1)

- May 2016 (1)