Share this

The 5 Pillars of Digital Growth and Transformation

by Audrey Cannata on August 16, 2021

“It's more important than ever as a financial institution, as a traditional institution or a non-traditional institution, to have purpose around how you treat your customers because we all know it takes a certain amount of energy to get a client. It takes even less energy to keep a client, but you got to be purposeful about how you spend that energy.” – Jeffrey Ward

Digital transformation is thrown around a lot.

For years, it’s been a buzzword in every industry, and now it’s dramatically changing the way that banks and credit unions interact with their customers and members.

Many financial leaders claim that they’re aiming to transform their operations, but few actually do.

Why is this?

Usually, it’s because they are missing one key ingredient…

According to Jeffrey Ward, this is because they are usually missing one of five pillars of digital growth and transformation:

The Five Ps.

Jeffrey is the Enterprise Executive at TurnKey Lender. He is also the host of the LinkedIn Live video series 15 Minutes, where he has already interviewed dozens of leading minds in financial brand marketing, sales, and FinTech. He recently spoke with James Robert Lay, host of the podcast Banking on Digital Growth.

What Does Digital Transformation Mean for Banks?

Digital transformation is being muttered and pondered by leaders throughout the financial industry.

But what does this really mean? And how can it impact a financial institution?

Those in the financial world are already seeing what this looks like in the form of employees developing their own personal brand.

While this gives employees the chance to broaden their network and their understanding of the importance of FinTech, it also helps these employees see firsthand the importance of transforming banking and lending.

Connecting with people and building relationships in the digital world means building an interwoven community that spans the country and sometimes even the world. It means that banks — and their employees — can have a bigger impact than they ever thought possible when working in a digital context.

Digital transformation also opens up financial brands to better serve their customers with purpose, passion, and intention.

It allows banks to put others first, and when financial brands lead with this kind of passion, it runs from the CEO all the way to the solution engineer. And? It drives the customer experience.

The Five Ps of Digital Growth

Digital transformation should be supported by five separate pillars — five ideals that serve as the gravitational force.

1. Passion

Passion may be the most important force behind digital transformation. For banks and credit unions, finding what they are most passionate about can also serve as a differentiation factor; it’s what sets them apart. And it can act as a compass for digital growth and transformation to find ways to best serve the client.

As for Jeffrey, “Passion can touch everything that I can do. It can touch my skillset, it can touch my education, it can touch my communication, it can touch my approach. I think passion is a very important key to success for any type of role that you do.”

2. Purpose

With purpose comes intention. Jeffrey explained the need for purpose, stating, “You’ve got to have a reason to be at the table. You’ve got to have a value proposition.”

Jeffrey shared that understanding his personal network and the value that they bring to his work and to digital transformation provides a sense of purpose.

It's more important than ever as a financial institution to have purpose around how customers are treated. It takes a certain amount of energy to obtain clients. It takes less energy to maintain clients. But? Banks must be purposeful about how they spend that energy.

3. Performance

When considering implementing change as big as something like digital transformation, it’s easy to get wrapped up in small details instead of the bigger picture.

Optimizing performance is easier when the goal is clear and discernible — when there’s a sense of purpose. When banks and credit unions have strong leadership — individuals who aren’t afraid to share their expectations — it makes it easier for the entire team to work together at a high-performing level to achieve these goals.

If banks can’t actually execute their visions, then everything else falls apart. It takes clarity to execute correctly. When it comes to digital transformation and the introduction of new technologies and new systems, financial brands must be clear about what they are trying to achieve with the implementation of these new tools — the problems they are going to solve.

A lack of clarity leads to confusion, conflict, and chaos, which is likely why more than 80% of digital transformation projects fail. It’s not the technology itself that fails. It’s about the clarity of expectation and what kind of performance is expected.

Technology is just a tool. Digital transformation fails because leaders failed to set the proper expectations, and therefore the people lack the clarity that they need to perform.

4. Patience

Change is painful. And taxing. It also requires humility. So when financial brands are approaching digital transformation, they also need a great deal of patience.

As Jeffrey shared, “Patience is taking a moment to appreciate our fellow brothers and sisters. We're all trying to do this. We're all going in the same direction, and we may not all share or have the same tolerance for the direction that we're going. If you can have a little bit of patience, it just seems to make things a lot easier for us all.”

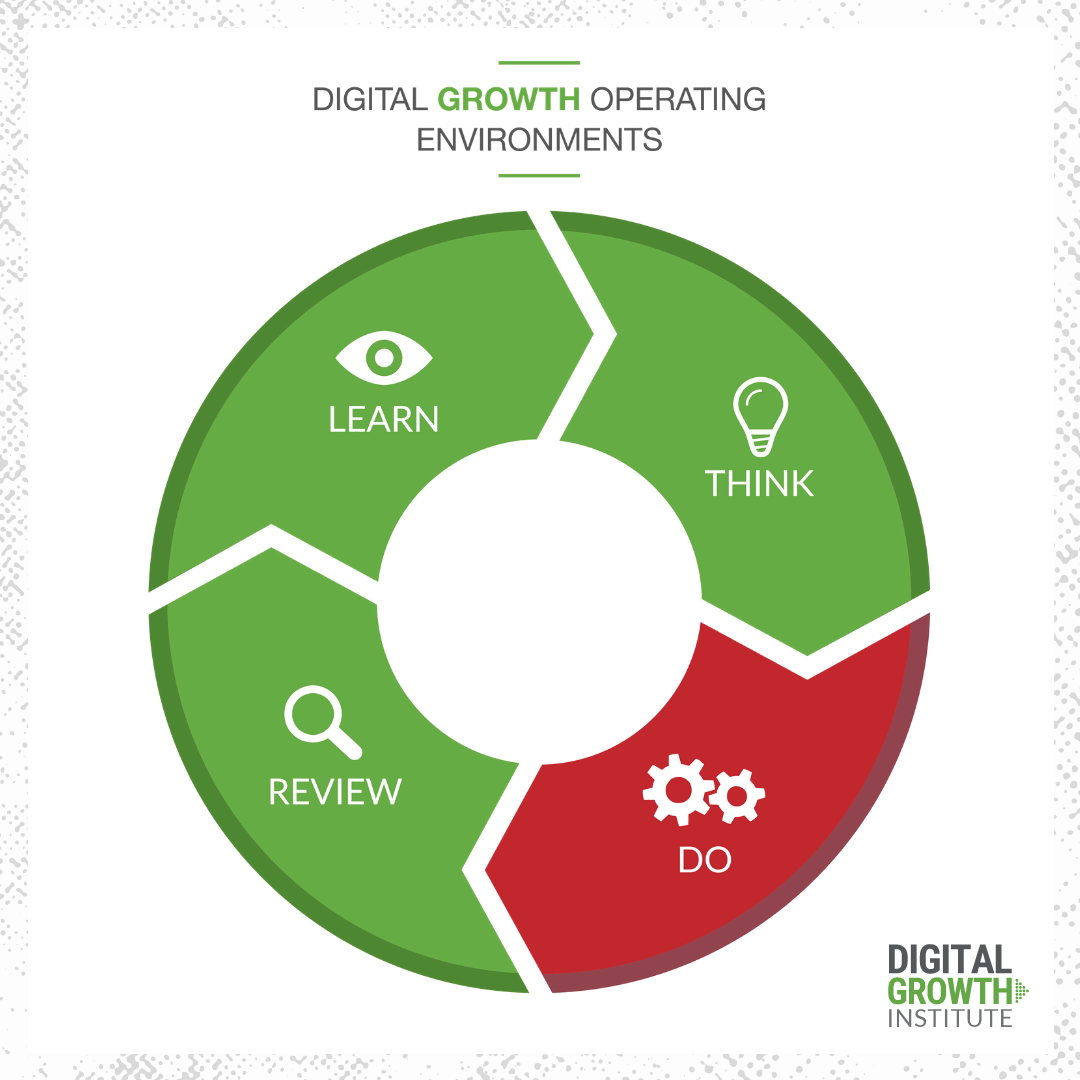

Digital growth happens through operating in four separate environments:

- Learning

- Thinking

- Doing

- Reviewing

Real growth requires all four, but they can’t happen without patience. Patience means taking a moment to stop — to break free from the doing. To pause, to reflect, to review what's worked well and what can be made even better. It also means being grateful for progress throughout the organizational journey of growth.

5. Persistance

Disney fans will remember Dory’s mantra from the film Finding Nemo: “Just keep swimming.”

In the sea of the COVID-19 pandemic and the current post-COVID-19 chaos, digital transformation requires persistence. It demands that those in the industry just keep swimming.

Digital growth is a journey, a race. And it’s not a sprint; it’s a marathon, which takes incredible persistence.

As Jeffrey put it, “Persistence is continuous message, continuous content, continuous outreach, and continuous support of your clients. They may not all need me today. They may not all need me tomorrow, but sooner or later, they're going to need me. If I am not persistent, I may miss an opportunity.”

He continued, “You’ve got to be persistent. You’ve got to get up every day. You’ve got to put your messaging out there. You’ve got to put your content out there. And sooner or later, they're going to be ready for you. [But] you’ve got to be patient and persistent for that moment.”

Digital growth and transformation require commitment, courage, and confidence. With passion, purpose, performance, patience, and persistence, banks and credit unions can think of the health of their entire organization as they implement necessary, important change to build the bigger, better, and brighter future they want to see.

Share this

- September 2024 (1)

- July 2024 (3)

- June 2024 (2)

- May 2024 (3)

- March 2024 (1)

- December 2023 (1)

- October 2023 (2)

- September 2023 (3)

- August 2023 (6)

- July 2023 (8)

- June 2023 (5)

- May 2023 (6)

- April 2023 (1)

- March 2023 (5)

- February 2023 (5)

- January 2023 (5)

- December 2022 (1)

- November 2022 (5)

- October 2022 (5)

- September 2022 (6)

- August 2022 (9)

- July 2022 (7)

- June 2022 (6)

- May 2022 (8)

- April 2022 (11)

- March 2022 (7)

- February 2022 (4)

- January 2022 (4)

- December 2021 (1)

- November 2021 (4)

- October 2021 (5)

- September 2021 (4)

- August 2021 (4)

- July 2021 (5)

- June 2021 (6)

- May 2021 (3)

- April 2021 (6)

- March 2021 (3)

- February 2021 (6)

- January 2021 (8)

- December 2020 (10)

- October 2020 (4)

- September 2020 (5)

- August 2020 (9)

- July 2020 (12)

- June 2020 (1)

- March 2020 (1)

- January 2020 (1)

- December 2019 (1)

- July 2019 (1)

- April 2019 (1)

- May 2018 (1)

- January 2018 (2)

- December 2017 (3)

- November 2017 (3)

- October 2017 (3)

- August 2017 (1)

- June 2017 (2)

- May 2017 (1)

- April 2017 (1)

- February 2017 (1)

- January 2017 (1)

- December 2016 (1)

- September 2016 (2)

- August 2016 (1)

- July 2016 (1)

- May 2016 (1)