Share this

Driving Digital Sales in Financial Services in 2021: What’s Changed

by James Robert Lay on July 13, 2021

The last sixteen months have introduced so much change and upheaval that only now have those of us in the financial realm had the time to stop, take stock, and see how things are different.

According to one McKinsey survey, the upheaval caused by the COVID-19 pandemic means that:

- It’s three times more likely that 80 percent of customer relations are digital in nature.

- Rates of digital adoption in business are years ahead of where many expected them to be before the onset of the pandemic.

- It’s anticipated that of all the changes that happened over the past sixteen months, remote work, increasing migration to the cloud, and options to meet customer preferences for remote interactions will remain long after the danger of the pandemic subsides.

Compared to February or early March 2020, our world has gone through a massive transformation, seeing vast changes in nearly every facet of our lives in such a short period. The financial world is no exception, especially for those who work in small banks, credit unions, and other local institutions.

The Change in Digital Sales

Consumers today expect that they can do things like research options and make purchases on their phones. But this doesn’t mean that just because they can open an account on their phones that they definitely will do so.

Banks and credit unions need to take this opportunity to look at their digital sales models and see what has changed the most, which includes the merging of the worlds of marketing and sales. The way people shop for financial products and buy financial products has seen quite a bit of transformation.

In years past, there were two points to the buying journey:

- Awareness of a brand and their product through channels like broadcast marketing, television and print ads, and some online marketing

- Purchasing the financial products they want and need, like checking accounts or mortgages.

Between these two stages, there is a clear separation between sales and marketing.

However, thanks to digital transformation, that gap is filled with another stage in the buying journey: The consideration stage.

This simplifies things for buyers, but it makes the marketing and selling process a bit trickier for financial institutions, who must find ways to appeal to consumers during the consideration stage through digital venues.

When things changed overnight with the pandemic, financial institutions had to change the way they conduct both sales and engagement. They must now disrupt their previous business model or stop growing.

And truthfully? Those who are the most comfortable in the discomfort that comes along with this kind of change are the ones who experience the most success.

So what have brands learned during this time?

- Digital sales aren’t just for dabbling anymore.

- Digital transformation is now a table stakes game.

Pre-pandemic, digital transformation had already begun, but in many industries including the world of finance, this adoption of new methods and technologies wasn’t moving very quickly. Financial institutions, in particular, had to reset the stakes; they discovered the importance of digital transformation.

But digital transformation is about so much more than online banking or mobile apps. Many financial institutions who before the pandemic thought they were in a good place with regards to their digital transformation and use of data and analytics found that they were not where they thought they were. Consumer expectations changed so quickly. And digital sales and digital processes needed to change to keep pace.

Purpose: The Biggest Opportunity for Growth

Digitally speaking, for many small banks, credit unions, and other financial institutions, the events of the COVID-19 pandemic can be compared to a trip to the doctor for an annual check-up. They arrived at the doctor’s office thinking they were in optimal health, but COVID-19 showed the reality of what was going on underneath the skin, laying bare pain points in their digital growth and optimization.

Now is the time for financial firms to ask themselves,

“Why are we doing what we are doing as a brand?”

When it comes to digital transformation, many are reluctant to adopt change or thought that before March 2020 that they were already in prime digital health.

But when it comes to finding growth in digital sales, the old methods just don’t work anymore. By examining why financial firms do what they do, the path to growth becomes clearer.

So..."Why are we doing what we are doing as a brand?”

Is it about the commoditization of financial products (which is unsatisfying and ineffective, at best), or is it about transforming the lives of consumers?

The COVID-19 pandemic exposed all the ways that legacy ideas surrounding the marketing and sales of products no longer serve the customers, and that includes marketing products over purpose.

For financial institutions looking for growth, even in a digital-first world, the roadmap starts with finding their purpose. Sure, a brand’s mission and vision are important, but purpose will define the opportunity each brand has to connect in the financial marketplace.

And ultimately? Purpose is the only thing that can bring humanity back to banking.

Branding, Empathy, and Trust

In this new, digital-first financial industry, branding is more important than ever. Since marketing can no longer be about products and commoditization since there is no real human connection, it must instead be about what the company represents.

It’s about branding and finding a sense of empathy.

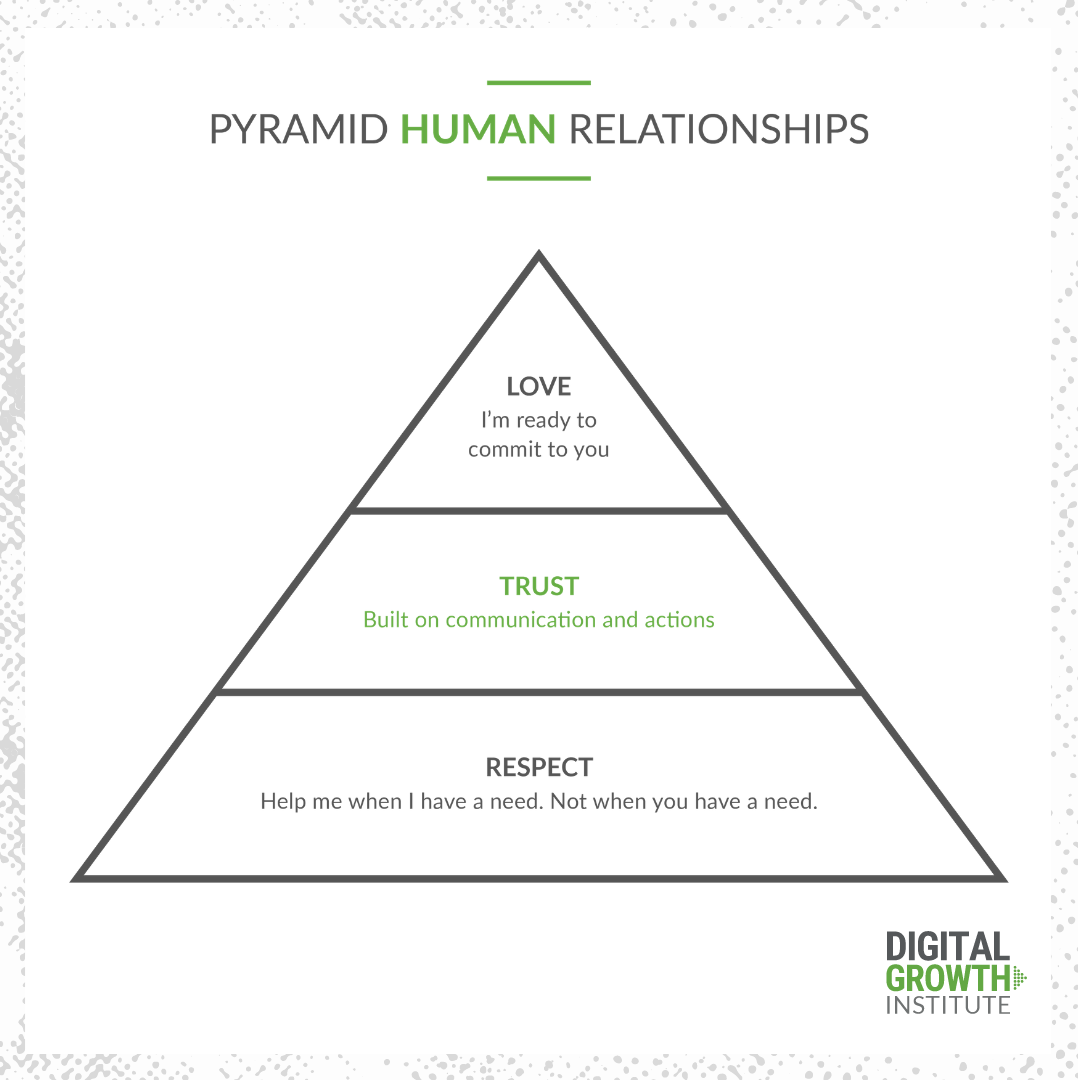

How does this fit into this new digital sales model from a tactical standpoint? It has a lot to do with what I refer to as the pyramid of human relationships.

At the bottom, foundational level of this pyramid lies the biggest need consumers have: Respect. They are searching for a financial brand that is there to help them when they have a need, not when the brand is in need—which is how things were for far too long.

At the pinnacle of this relationship pyramid? Love. In the financial industry, love looks like commitment; it’s opening an account, securing a mortgage, or beginning a lasting business relationship.

But the gap between respect and love? The middle piece or bridge that many brands are missing is trust. Trust is built on what brands say and do, and branding is a major element of this conversation.

Branding can help inspire the feelings and emotions that grow a relationship of respect into one of love. In a digital world, trust is what we trade on. To a certain degree, it’s a kind of currency in an account. As a brand, it can take weeks, months, or even years to put enough trust deposits into a consumer’s “trust fund” to build up enough trust to help them take the next step in their relationship.

On the flip side? It can take just minutes, or even one bad experience, to deplete this trust fund altogether.

Consumers can make choices to commit or abandon a brand in their buying journey in a matter of nanoseconds and sometimes, an organization may not even realize that a consumer has gone; they may not always see or understand the relationships that are breaking down behind the scenes. It’s up to financial institutions to continue to make deposits in these metaphorical “trust funds” to help consumers make the best choice for them.

Going "A.L.L." In

The reality of marketing for financial institutions used to revolve around which products were hot at different times of the year: Auto loans were popular in the fall and equity lines of credit hit their peak in the spring, and so forth.

But banks and credit unions took these marketing paths without any kind of data to back them up. With digital sales becoming more and more the norm, the question must become, “How can organizations move away from this push sales model to one that identifies the exact needs of consumers and suggests the perfect, proactive recommendations?”

Essentially, marketing and sales teams need to put people back at the center of their thinking and doing to stay sustainable. Otherwise, it’s easy for brands to fall back on what they know and get trapped in the cave of complacency.

By asking the right questions, brands may find niche market segments they never realized they had before. The best thing about this? It means they no longer have to try to be all things for all people.

When banks and credit unions introduce things like personal development, big data, and thick data, they can get into the hearts and minds of real people and transform their lives, giving them the opportunity for love and commitment.

Think of it as going “ALL” in:

- Ask

- Listen

- Learn

This might involve talking to the front line, asking questions, and finding out from consumers what keeps them up at night, and what pains or questions they may have. But it also means finding out what’s next for them: The hopes and dreams they want to achieve.

Answering these questions can drive the next step: Content production and promotion that is framed around unlocking these specific hopes and dreams. Then, the process becomes guiding consumers through the buying journey of awareness, consideration, and purchase.

When we ask, listen, and learn from real consumers, we can best meet their needs online and off, create customers for life, and build a bigger, better, brighter future.

Share this

- September 2024 (1)

- July 2024 (3)

- June 2024 (2)

- May 2024 (3)

- March 2024 (1)

- December 2023 (1)

- October 2023 (2)

- September 2023 (3)

- August 2023 (6)

- July 2023 (8)

- June 2023 (5)

- May 2023 (6)

- April 2023 (1)

- March 2023 (5)

- February 2023 (5)

- January 2023 (5)

- December 2022 (1)

- November 2022 (5)

- October 2022 (5)

- September 2022 (6)

- August 2022 (9)

- July 2022 (7)

- June 2022 (6)

- May 2022 (8)

- April 2022 (11)

- March 2022 (7)

- February 2022 (4)

- January 2022 (4)

- December 2021 (1)

- November 2021 (4)

- October 2021 (5)

- September 2021 (4)

- August 2021 (4)

- July 2021 (5)

- June 2021 (6)

- May 2021 (3)

- April 2021 (6)

- March 2021 (3)

- February 2021 (6)

- January 2021 (8)

- December 2020 (10)

- October 2020 (4)

- September 2020 (5)

- August 2020 (9)

- July 2020 (12)

- June 2020 (1)

- March 2020 (1)

- January 2020 (1)

- December 2019 (1)

- July 2019 (1)

- April 2019 (1)

- May 2018 (1)

- January 2018 (2)

- December 2017 (3)

- November 2017 (3)

- October 2017 (3)

- August 2017 (1)

- June 2017 (2)

- May 2017 (1)

- April 2017 (1)

- February 2017 (1)

- January 2017 (1)

- December 2016 (1)

- September 2016 (2)

- August 2016 (1)

- July 2016 (1)

- May 2016 (1)