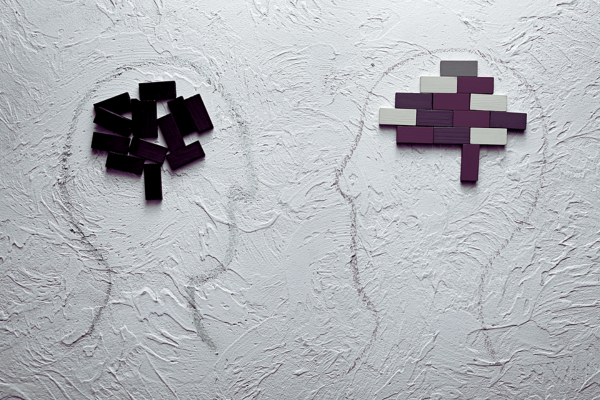

Logic Meets Intuition: Strategic Growth in Banking

by James Robert Lay on November 13, 2024

In the realm of strategic planning, branding, and marketing for financial institutions, there exists a continuous tension between using pure logic and rationale versus tapping into feelings, emotions, and intuition. Leaders and marketing professionals often struggle with balancing the …

Why Playing it Safe is Risky Business for Bank and Credit Unions Leaders

by James Robert Lay on November 12, 2024

Risk aversion has become a paralyzing force within banks and credit unions, particularly in marketing and sales teams. For institutions that prioritize security, the common reflex is to avoid taking bold action—often to prevent failure or blame. However, as Audrey Cannata and James Ro …

The 3-Step Framework for Change: A Path to Growth for Financial Institutions

by James Robert Lay on November 5, 2024

Change is hard—especially in the financial industry, where traditional approaches can feel like a comfortable safety net. But as financial brands aim to grow and stay relevant, inaction or rigid mindsets can hold entire teams back. Adapting to new technologies, customer expectations, …

Leadership Burnout in Financial Services: Why Staying Stuck is No Longer an Option

by James Robert Lay on November 4, 2024

Many financial brand leaders feel stuck and unable to take the necessary actions to overcome the challenges they face. This sense of being stuck can stem from several factors, including pride, arrogance, fear of conflict, and the fear of looking in the mirror and confronting unpleasan …

Digital vs. Human: The First Step to Unlocking Growth in Financial Services

by James Robert Lay on October 29, 2024

Financial brands often focus on digital transformation and new technologies to drive growth, but they miss a critical piece: human transformation. Without aligning their teams and culture to embrace change, even the best technology won’t unlock new opportunities. Sticking to old habit …

The Digital Growth Accelerator: The Fastest Way to Thrive in 2025

by James Robert Lay on October 28, 2024

There’s no sugar coating it: Your bank or credit union is losing money—right now—because of hidden blind spots in your customer journey. If you don’t take action, these problems will persist, costing you even more in 2025. The longer you wait, the more you risk falling behind your com …

The Future of Financial Branding: Building Trust and Influence through Content

by James Robert Lay on October 22, 2024

Financial brands miss out on millions in loans and deposits by not leveraging digital growth strategies and personal branding. There's a hesitation to utilize new communication channels like social media or podcasts due to compliance concerns and traditional mindsets. Ray Drew, top-pr …

Humanizing Digital Experiences: A True Story of Why People Still Matter

by James Robert Lay on October 21, 2024

In today's digital age, creating a human connection in online interactions is crucial for enhancing customer journeys, especially for financial institutions. However, many banks and credit unions overlook this necessity, leading to missed opportunities and diminished customer satisfac …

The Power of Movement: Mastering Your Body to Master Your Mind

by James Robert Lay on October 15, 2024

In this episode of the Practical Perspectives series, James Robert Lay and Audrey Cannata discuss a powerful yet often overlooked connection—the relationship between physical movement and overcoming mental roadblocks like fear, anxiety, and complacency. They explore the idea that taki …

Mastering Onboarding and Engagement for Banks and Credit Unions

by James Robert Lay on October 14, 2024

In this special episode of the Exponential Insights, James Robert Lay is joined by both Corey LeBlanc, co-founder and COO/CTO at Locality Bank, and Har Rai Khalsa, CEO and co-founder of Swaystack. Together, they dive deep into the critical topic of optimizing onboarding and engagement …

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)