The Long Game of Marketing: Planting Seeds for Future Growth

by James Robert Lay on December 17, 2024

Billy Wilkinson, CEO of Threshold, the agency that will make you rethink how you market your everything, joins the show to explore the transformative power of marketing in the financial services industry. Together, they discuss the importance of mastering the fundamentals—what Billy c …

From Artificial to Authentic: Rethinking AI's Role in Human Connection and Banking

by James Robert Lay on December 10, 2024

In an era where artificial intelligence (AI) dominates headlines and disrupts industries, financial brand leaders face a dilemma: is "artificial" truly good for building trust, fostering connection, and driving growth?

Small Businesses, Big Potential: Navigating Change in Community Banking

by James Robert Lay on December 2, 2024

Small business owners and community financial institutions face significant challenges in navigating the rapidly changing landscape of AI and digital growth. Limited knowledge and outdated beliefs can hinder future growth and collaboration opportunities, particularly in the SBA lendin …

Transform Your Relationship with Money: Changing Beliefs and Building Wealth

by James Robert Lay on November 25, 2024

For many, money feels more like a burden than a blessing. Guilt, shame, fear, and self-sabotage often sabotage our ability to achieve financial freedom, leading to cycles of stress and unfulfilled goals. These struggles aren't just about numbers—they're rooted in deep-seated beliefs f …

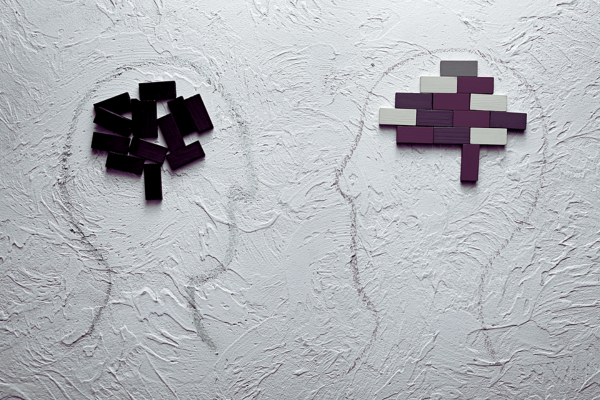

Logic Meets Intuition: Strategic Growth in Banking

by James Robert Lay on November 13, 2024

In the realm of strategic planning, branding, and marketing for financial institutions, there exists a continuous tension between using pure logic and rationale versus tapping into feelings, emotions, and intuition. Leaders and marketing professionals often struggle with balancing the …

The 3-Step Framework for Change: A Path to Growth for Financial Institutions

by James Robert Lay on November 5, 2024

Change is hard—especially in the financial industry, where traditional approaches can feel like a comfortable safety net. But as financial brands aim to grow and stay relevant, inaction or rigid mindsets can hold entire teams back. Adapting to new technologies, customer expectations, …

Digital vs. Human: The First Step to Unlocking Growth in Financial Services

by James Robert Lay on October 29, 2024

Financial brands often focus on digital transformation and new technologies to drive growth, but they miss a critical piece: human transformation. Without aligning their teams and culture to embrace change, even the best technology won’t unlock new opportunities. Sticking to old habit …

The Future of Financial Branding: Building Trust and Influence through Content

by James Robert Lay on October 22, 2024

Financial brands miss out on millions in loans and deposits by not leveraging digital growth strategies and personal branding. There's a hesitation to utilize new communication channels like social media or podcasts due to compliance concerns and traditional mindsets. Ray Drew, top-pr …

Mastering Onboarding and Engagement for Banks and Credit Unions

by James Robert Lay on October 14, 2024

In this special episode of the Exponential Insights, James Robert Lay is joined by both Corey LeBlanc, co-founder and COO/CTO at Locality Bank, and Har Rai Khalsa, CEO and co-founder of Swaystack. Together, they dive deep into the critical topic of optimizing onboarding and engagement …

Unlocking Digital Growth: Bridging the Gap Between Data and Action

by James Robert Lay on October 9, 2024

In today's episode of the Exponential Insights series we discuss a significant issue faced by financial institutions: the loss of loans and deposits via their websites. Despite the clear advantages, many credit unions and banks struggle with the digital transformation needed to optimi …

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)